NEXIM Bank Soars with Impressive N30.47bn Operating Profit!

The Nigeria Export-Import Bank (NEXIM) has announced a remarkable operating profit of N30.47 billion for the fiscal year ending 2024, more than doubling the previous year’s N13.75 billion. This surge highlights the bank’s robust growth and adaptability despite prevailing economic challenges.

In addition, NEXIM received a Bbb+ credit rating from the reputable agency Agusto & Co. Limited, reflecting its solid financial health and strong ability to fulfill obligations compared to other development finance institutions (DFIs) within Nigeria.

This financial advancement demonstrates the bank’s operational strength and resilience.

Founded with the mission to boost Nigeria’s non-oil export sector and support businesses that reduce import dependency, NEXIM is fully owned by the Federal Government of Nigeria, with equal stakes held by the Central Bank of Nigeria (CBN) and the Ministry of Finance Incorporated (MOFI).

The institution has sustained healthy liquidity and capital adequacy levels, alongside significant expansion in its lending portfolio and equity investments. It primarily backs industries such as manufacturing, agriculture, solid minerals, and service sectors.

Abba Bello, the bank’s managing director, revealed that NEXIM has escalated its support for the non-oil export market, disbursing over N495 billion. This funding has contributed to the creation and maintenance of more than 36,000 direct and indirect employment opportunities.

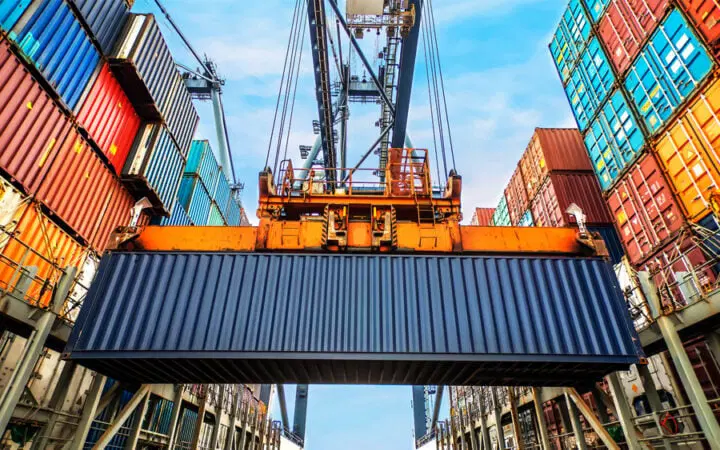

Currently, the bank is spearheading several strategic projects, including a regional Sealink initiative developed through a public-private partnership to enhance maritime logistics across West and Central Africa. It is also expanding alternative export financing solutions tailored for SMEs and has launched a joint project preparation fund with Afreximbank to improve the viability of export ventures.

Moreover, NEXIM is crafting specialized financing products for the mining industry, such as Contract Mining, Equipment Leasing, and Buyers’ Credit/ECA Financing. These schemes aim to unlock export capacity and increase foreign exchange inflows.

“Our commitment at NEXIM Bank is to strengthen local processing capabilities and elevate Nigeria’s role in international trade by advancing up the commodity value chain and boosting non-oil export revenues,” the bank stated recently.