NEXIM Soars to New Heights: Achieves Bbb+ Rating and Doubles Profit in 2024!

The Nigerian Export-Import Bank (NEXIM) has achieved a Bbb+ credit rating from Agusto & Co. Ltd., underscoring its solid financial health and dependable status among Nigeria’s development finance institutions (DFIs).

According to its 2024 financial statement, NEXIM posted an operating profit of N30.47 billion, more than doubling the N13.75 billion recorded in the previous year, demonstrating enhanced operational effectiveness.

Established as a joint venture between the Central Bank of Nigeria (CBN) and the Ministry of Finance Incorporated (MOFI), NEXIM’s mandate is to stimulate non-oil export activities and back enterprises that reduce import dependency within Nigeria.

The bank’s report highlighted strong liquidity and capital adequacy metrics, alongside notable expansion in its lending and equity investment portfolios spanning sectors such as manufacturing, agriculture, solid minerals, and services.

Managing Director Abba Bello emphasized that NEXIM has significantly increased its support for non-oil exporters, channeling over N495 billion into various development finance projects nationwide.

Bello further revealed that these financing initiatives have generated and maintained upwards of 36,000 direct and indirect employment opportunities, fostering economic resilience and inclusive growth across diverse industries.

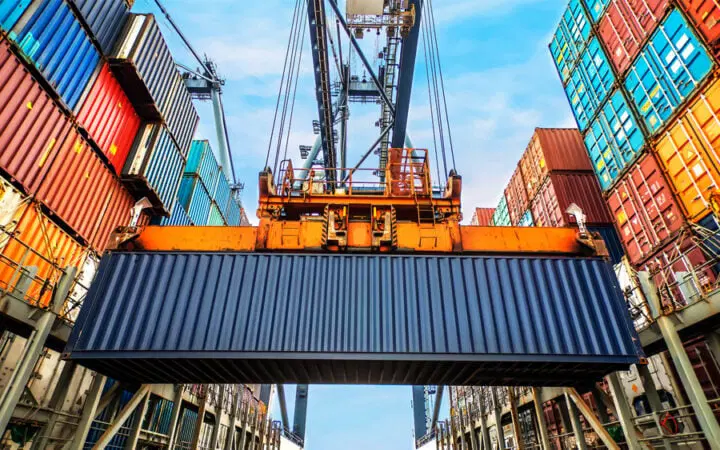

Among the flagship projects is the Regional Sealink initiative, a collaborative maritime venture aimed at enhancing trade and logistics connectivity across West and Central Africa by improving sea transport infrastructure.

“Additional programs include advancing factoring solutions tailored for SMEs and launching a Joint Project Preparation Fund (JPPF) in partnership with Afreximbank to boost the feasibility of large-scale export-driven ventures,” Bello explained.

He also noted that NEXIM is developing specialized financing frameworks for the mining sector, such as Contract Mining arrangements, Equipment Leasing options, and Buyers’ Credit/ECA Financing schemes, to tap into Nigeria’s vast mineral export potential.

Bello reaffirmed the bank’s dedication to expanding local value addition, increasing foreign exchange inflows, and elevating Nigeria’s position in the global trade arena through strategic support of non-oil export sectors.