Discover 6 Top Investment Platforms in Nigeria That Will Boost Your Wealth!

In Nigeria, cash transactions dominate the economy, and credit options remain relatively scarce. This reality raises important questions about how individuals can effectively create, grow, and maintain wealth, with investment being a key strategy. Yet, investing is not a one-size-fits-all journey; there are numerous avenues to explore, including mutual funds, fixed income instruments, Exchange Traded Funds (ETFs), among others.

Tijesunimi Oresanya, Manager of Solution Architecture (CEMEA) at Visa, emphasizes the importance of setting clear investment objectives from the outset. “Many newcomers aim for financial independence but fail to specify what that means personally,” he explains. “Clarifying whether you want to invest for the short or long term helps determine your risk appetite and guides the choice of suitable investment vehicles.”

When evaluating various investment options and platforms, Oresanya advises paying close attention to associated costs, particularly brokerage fees. “Investment platforms often charge service fees, which beginners might overlook. Even a seemingly small 1% fee can accumulate substantially over time,” he warns.

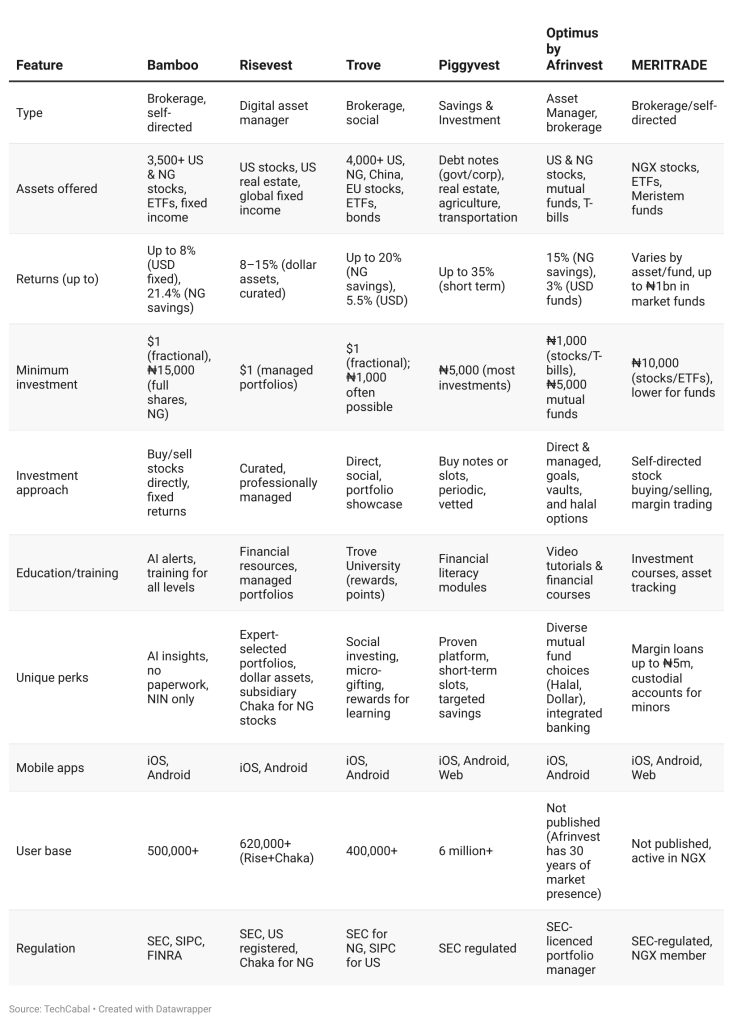

Popular Investment Platforms in Nigeria

After consulting financial experts and gathering feedback from experienced investors, here’s a curated list of apps worth considering for those interested in the Nigerian stock market. Whether you prefer a digital wealth manager or a brokerage app for direct trading, these platforms offer diverse features to suit different investor needs.

1. Bamboo

Bamboo provides access to over 3,500 stocks and offers educational materials for both novices and seasoned investors. With a user base exceeding 500,000, the app uses AI-powered market analysis to notify users of promising investment opportunities.

Opening an account requires minimal paperwork-just your contact information and National Identification Number (NIN). Bamboo supports trading in Nigerian and U.S. stocks and ETFs, with fixed income products offering up to 8% annual returns in USD and as high as 21.4% on Naira savings. Investments can start from as little as $1, making it accessible to many.

The Bamboo app is downloadable on both the App Store and Google Play.

Summary:

- Trade U.S. and Nigerian stocks with ease

- Simple onboarding with just NIN and contact details

- Start investing with as little as $1

2. Risevest

Risevest specializes in dollar-based investments across global and U.S. markets, including real estate, with expected returns between 8% and 15%.

Unlike brokerage apps, Risevest operates as a digital asset manager, curating diversified portfolios in U.S. stocks, real estate, and global fixed income to balance risk and reward. Users entrust their funds to investment professionals who manage the portfolios on their behalf.

With a combined user base of over 620,000 (including its subsidiary Chaka), Risevest is accessible via mobile on the Play Store and App Store.

Summary:

- Invest in dollar-denominated assets managed by experts

- Access portfolios in U.S. stocks, real estate, and global fixed income

- No direct trading; professional management only

3. Trove

Trove offers a platform to invest in over 4,000 assets spanning Nigerian and U.S. markets. It also features Trove University, an educational hub where users can earn points redeemable for airtime, data, or trading fee discounts.

Through microinvesting, Trove enables users to gift shares to friends and family. Its social investing feature allows investors to connect, view others’ portfolios, and learn from their strategies. There is no minimum investment amount, with returns up to 20% annually on Naira savings and 5.5% on U.S. dollar savings.

With over 400,000 users, Trove is available on the App Store and Google Play.

Summary:

- Social investing tools to engage with peers and experts

- Earn rewards through investment education

- Invest from as little as $1

4. Piggyvest

Initially a savings platform, Piggyvest now offers diverse investment options with durations of 6 to 12 months and returns up to 35%. Its Investify product lets users buy Corporate Debt Notes starting at ₦5,000, backed by reputable companies, or Sovereign Debt Notes backed by the government, with minimums between ₦12,000 and ₦19,000.

Additionally, Piggyvest provides access to vetted opportunities in sectors like real estate, agriculture, and transportation. These options are often limited and sell out quickly, so timely action is essential. The platform boasts nearly 6 million users and is accessible via its web app and mobile apps on the App Store and Google Play.

Summary:

- Start investing with as little as ₦5,000

- Short to medium-term investments with high returns

- Access to pre-screened real estate, agriculture, and transport projects

5. Optimus by Afrinvest

Operated by Afrinvest Asset Management Limited, a SEC-licensed portfolio manager, Optimus by Afrinvest offers investments in Nigerian and U.S. stocks, mutual funds, fixed deposits, and other high-yield products.

The platform features unique mutual funds such as the Shariah-compliant Afrinvest Halal Fund, the Afrinvest Plutus Fund with a minimum investment of ₦5,000, and the Afrinvest Dollar Fund for short to medium-term dollar investments. It also integrates savings and investment management in one secure app, allowing investments from as low as ₦1,000.

Optimus is available on the App Store and Google Play.

Summary:

- Invest in Nigerian stocks and treasury bills with minimal capital

- Access Shariah-compliant and dollar-denominated mutual funds

- Combine savings and investments on a single platform

6. MERITRADE by Meristem

MERITRADE by Meristem empowers investors to act as their own brokers, enabling direct buying and selling of stocks. Users can open personal accounts or custodial accounts for minors. The platform also offers tools to monitor existing holdings and provides both technical and fundamental stock analysis.

As of early 2025, the Meristem Equity Market Fund managed assets exceeding ₦1 billion, reflecting strong market trust. MERITRADE supports margin trading, allowing new investors to borrow up to ₦3 million and existing users up to ₦5 million against their portfolios. The app also offers beginner-friendly investment courses and is available on the App Store and Google Play.

Summary:

- Direct stock trading with margin loan options

- Track long-term investments and manage accounts for minors

- Educational resources for investors

Many investors diversify their portfolios to balance risk and returns. Lydia Oke, a seasoned investor, shares, “My objectives for Naira investments differ from those for my dollar investments.” She currently uses Meristem for Naira assets, Bamboo for dollar investments, and Stanbic for mutual funds, creating a well-rounded portfolio leveraging each platform’s strengths.

Steps to Invest in the Nigerian Stock Market

To participate in Nigeria’s stock market, you must first open a brokerage account. This can be done through established brokerage firms like Afrinvest, CSL by FCMB, FBNQuest, or Stanbic IBTC. Alternatively, you can open an account via mobile investment apps like Bamboo or Piggyvest.

Typically, you’ll need the following documents:

- A Nigerian bank account

- Bank Verification Number (BVN)

- A recent passport photograph

- Valid identification such as a driver’s license, international passport, or National ID card

- Proof of address, usually a utility bill

Once your brokerage account is set up and verified, you will receive a Central Securities Clearing System (CSCS) account within 24 to 48 hours. This account electronically holds your shares and certificates. After funding your CSCS account via your Nigerian bank, you can start trading either through your brokerage or via investment apps.

The Nigerian stock market operates from 9:30 AM to 2:30 PM daily, which are the hours during which trading activities occur.

Investment Options Starting at ₦10,000

With ₦10,000, you can acquire corporate debt notes on Piggyvest starting at ₦5,000 per unit, allowing you to buy multiple units if desired. Risevest permits global market investments with a minimum of $10 (approximately ₦14,910). Bamboo also offers fixed income products starting at $1, providing a 7.5% return in dollar terms.

How to Earn ₦1,000 Monthly from Investments

One way to generate a steady monthly income is through fixed deposit plans with your bank, where you can arrange to receive monthly interest payouts instead of reinvesting them. However, reinvesting interest can compound your returns over time, potentially yielding greater long-term gains.

Investing with Just ₦100

Optimus by Afrinvest enables investments in mutual funds starting from as little as ₦100 via their mobile app. Similarly, Risevest and Trove facilitate microinvesting, allowing you to buy fractional shares with a minimum of $1 (around ₦1,491).

*Note: Exchange rates used here are based on ₦1,490.98 to $1. Individual platforms may apply different rates.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers should conduct their own research and consult qualified financial, legal, and tax professionals before making investment decisions.

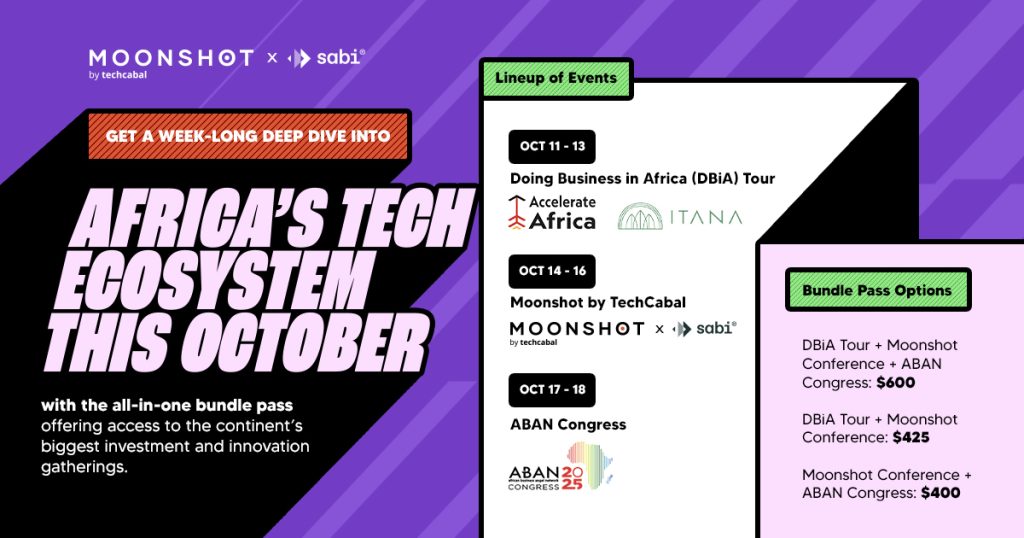

Save the date! Moonshot by TechCabal returns to Lagos on October 15-16. Join Africa’s leading entrepreneurs, creatives, and tech innovators for two days of inspiring talks, networking, and forward-thinking ideas. Secure your tickets now at moonshot.techcabal.com.

Leave a Reply