CBN Launches Bold Phase Reform to Boost Transparency in Fixed Income Market

…As Banks’ Deposits with CBN Reach an Unprecedented N6.08 Trillion

The Central Bank of Nigeria (CBN) has unveiled a comprehensive set of operational reforms aimed at boosting transparency, efficiency, and regulatory oversight within the Nigerian Fixed Income Market.

In a communication titled “Operational Changes to the Nigerian Fixed Income Market” addressed to the Financial Markets Dealers Association (FMDA), the CBN detailed pivotal adjustments intended to enhance the market’s role as a vital mechanism for monetary policy execution and economic progress.

These initiatives come amid a record surge in commercial banks’ deposits with the CBN through the Standing Deposit Facility (SDF), which recently hit N6.08 trillion, underscoring the urgency for improved liquidity management and market coordination.

Revamped Oversight and Settlement Framework

The new structure entrusts the CBN with full control over the settlement process and trading platform of the fixed income market. This marks a fundamental shift, as the Bank will now directly manage the entire settlement lifecycle through its established financial market infrastructure.

The CBN’s objective is to uphold market integrity, simplify operational workflows, and establish a cohesive regulatory environment that provides comprehensive transaction transparency and strengthens supervisory capabilities. This reform aims to remove unnecessary intermediaries that have traditionally operated between key market players such as banks and pension fund administrators (PFAs).

While FMDQ will continue to operate, its role will pivot towards supporting functions rather than settlement management. The CBN clarified that this transition does not replace the existing trading platform but rather centralizes settlement responsibilities to improve transparency and operational efficiency.

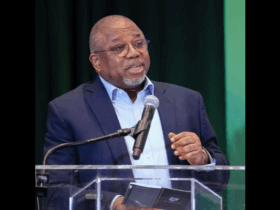

Insights from Industry Specialists

Ayodele Akinwunmi, Chief Economist at United Capital Plc, views the reform as a strategic move by the CBN to establish a more transparent and efficient market infrastructure. He emphasized that enhanced access to precise data on fixed income securities will empower the CBN to better implement monetary policy, facilitating informed decisions on liquidity control, interest rate adjustments, and inflation management.

Akinwunmi remarked, “The CBN’s pursuit of end-to-end settlement visibility allows them to accurately gauge market trends and fine-tune policy instruments accordingly. While FMDQ has performed commendably, this initiative ensures a deeper level of regulatory oversight.”

Gradual Rollout to Ensure Smooth Adoption

To avoid market disruption, the CBN plans to implement these changes in phases, working closely with all stakeholders.

The initial phase involves User Acceptance Testing (UAT) slated for the second week of October 2025, designed to validate the new settlement system’s full functionality. Upon successful completion, a pilot phase will run alongside the current system to guarantee operational stability.

Key Dates for Full Implementation

The CBN aims to complete the migration of all fixed income settlement activities to the new platform by November 3, 2025. Subsequently, a CBN-backed trading engine will be launched on December 1, 2025, serving Primary Dealers, Market Makers, PFAs, and other authorized participants.

Emphasizing Collaborative Efforts

The CBN acknowledged the FMDA’s vital contribution to Nigeria’s financial markets and called for ongoing partnership to ensure the success of these reforms. The Bank reaffirmed its dedication to fostering a transparent, well-regulated fixed income market that promotes economic growth while protecting the interests of all market participants.

For further information or inquiries, stakeholders are encouraged to reach out to Okey Umeano, Acting Director of Financial Markets.

What is the Fixed Income Market?

The fixed income market is a segment of the financial ecosystem where debt securities, such as bonds, are issued and traded. These instruments typically provide investors with steady or predictable returns over a specified period. Issuers include governments and corporations, while investors range from individual savers to institutional entities like pension funds.

Due to its relatively stable return profile and lower risk compared to equities, the fixed income market plays a crucial role in capital allocation, liquidity management, and maintaining macroeconomic stability. This market relies on a network of issuers, investors, brokers, credit rating agencies, and regulators collaborating to ensure smooth and efficient operations.

Through these reforms, the CBN aims to cultivate a more transparent, efficient, and resilient fixed income market that better aligns with Nigeria’s monetary policy goals and broader economic development objectives.

Leave a Reply