Kenya Poised to Make History with Groundbreaking Crypto Law Awaiting President Ruto’s Approval

Kenya is poised to enact its inaugural cryptocurrency legislation following the Parliament’s approval of the Virtual Asset Service Providers (VASP) Bill, 2025, during its third reading on Tuesday. This landmark law, pending President William Ruto‘s signature, could position Kenya among the pioneering African countries to implement a definitive regulatory framework for digital assets.

Initially proposed in 2024, the bill designates the Central Bank of Kenya (CBK) alongside the Capital Markets Authority (CMA) as co-regulators overseeing digital asset activities. Additionally, the Treasury Cabinet Secretary will be empowered to issue comprehensive regulations covering stablecoins, asset tokenization, trading platforms, capital and solvency requirements, as well as anti-money laundering protocols.

After extensive deliberations at the committee stage and consultations with the public, Attorney General Dorcas Oduor is finalizing the bill for presidential approval. Legislators have indicated that the version passed in the third reading incorporates enhanced compliance and licensing provisions, although the updated text has yet to be made public.

This legislation sets the stage for Kenya to establish one of the continent’s most robust virtual asset regulatory systems, featuring explicit capital adequacy, solvency, and consumer protection standards for service providers. It will also create a formal licensing process for both domestic and international crypto enterprises currently operating in Kenya, such as Luno, Busha, KotaniPay, Fonbnk, Swypt, and Binance.

“With Parliament’s endorsement of the VASP Bill, Kenya is just one step away from setting a regulatory precedent,” remarked Chebet Kipingor, Business Operations Manager at Busha Kenya, a Nigerian crypto startup’s subsidiary. “This development signals that Africa’s leading innovative economy is prepared to harmonize technological advancement with consumer safeguards, prioritizing progress over apprehension in shaping our digital future.”

However, the competitiveness of these startups will largely depend on the specific regulatory standards and capital requirements established. The timing of this bill is also critical, as the Kenyan government faces mounting pressure to enhance financial oversight to facilitate removal from the Financial Action Task Force (FATF) greylist and to meet fiscal and revenue objectives linked to its IMF extended fund facility (EFF), which was terminated in March, according to an industry source who requested anonymity.

The ultimate impact hinges on the Treasury’s forthcoming subsidiary regulations, particularly how it defines capital adequacy, asset custody, and disclosure obligations for startups. These details will determine whether Kenya becomes the preferred hub for digital asset service providers in Africa or risks driving them to relocate abroad. President Ruto is anticipated to receive the finalized bill within the coming weeks, marking a significant milestone in Kenya’s journey toward comprehensive cryptocurrency regulation.

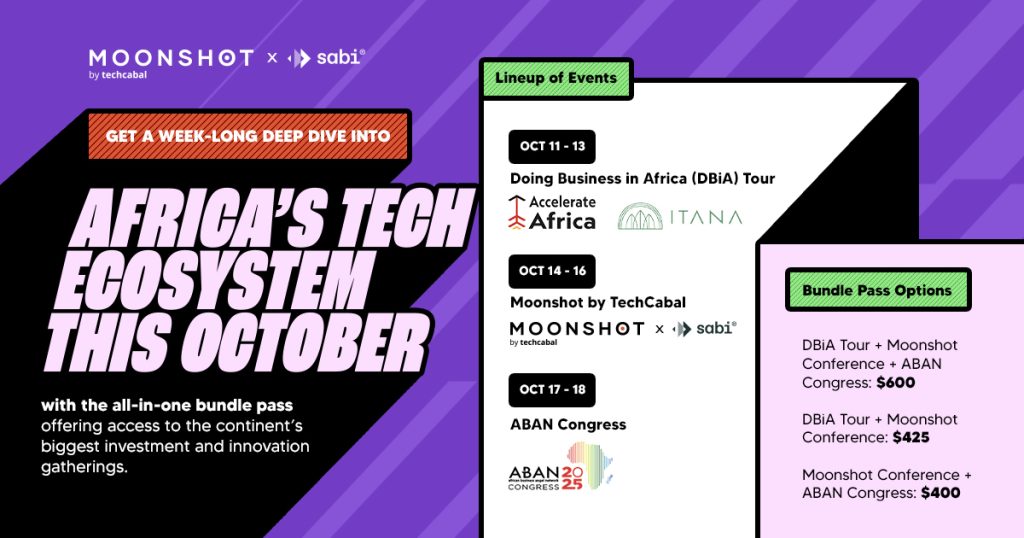

Save the date! Moonshot by TechCabal returns to Lagos on October 15-16! Join Africa’s leading founders, creatives, and tech innovators for two days filled with inspiring keynotes, networking events, and forward-thinking discussions. Secure your tickets today at moonshot.techcabal.com

Leave a Reply