Moniepoint Sets the Record Straight: $2.7M UK Funds Are a Strategic Growth Investment, Not a Loss

Moniepoint Inc has responded to recent reports suggesting that its UK branch, Moniepoint GB, is experiencing significant financial setbacks.

In a statement provided to Technext, a company representative clarified that what some perceive as losses are actually typical early-stage investments common to fintech firms entering newly regulated markets.

“Moniepoint Inc. confirms that the financial results for Moniepoint GB from February through December 2024 reflect the expected initial investment phase that financial service providers often undergo when expanding into regulated jurisdictions,” the spokesperson stated.

They added, “Moniepoint GB is focused on empowering the UK’s African diaspora through tailored financial solutions, a mission that requires upfront spending on compliance, technology infrastructure, and talent acquisition.”

The company pointed to its April 2025 launch of MonieWorld as the first public step in this strategic plan, with further product rollouts anticipated.

“The introduction of the MonieWorld digital financial platform in April 2025 marks a significant milestone in our vision, with additional services planned for launch in the near future. Moniepoint GB remains committed to adhering to all regulatory reporting requirements and timelines,” the fintech firm emphasized.

This clarification arrives amid circulating narratives that Moniepoint is “incurring heavy losses following its acquisition of Bancom Europe to obtain a UK license,” which has sparked debate about the challenges of expanding into regulated markets.

Moniepoint: Clarifying the Difference Between Strategic Investment and Loss During Market Entry

When fintech companies enter new territories, they often incur significant upfront costs related to licensing, regulatory compliance, hiring, and building infrastructure before turning a profit. Seen in this context, Moniepoint’s explanation aligns with industry standards, positioning its UK venture as a deliberate investment phase expected to operate at a deficit initially.

It’s also crucial to consider Moniepoint’s overall growth trajectory. In October 2024, the company raised $110 million in a Series C funding round, backed by investors including DPI, Google’s Africa Investment Fund, Verod Capital, and Lightrock. This capital infusion supports expansion beyond Africa, including diaspora-focused initiatives like MonieWorld.

While this expansion is ambitious, it must contend with regulatory hurdles, competitive pressures, and the complexities of monetizing diaspora remittance corridors in a crowded marketplace.

Moniepoint GB’s Strategy: Targeting Diaspora Remittances and Financial Inclusion

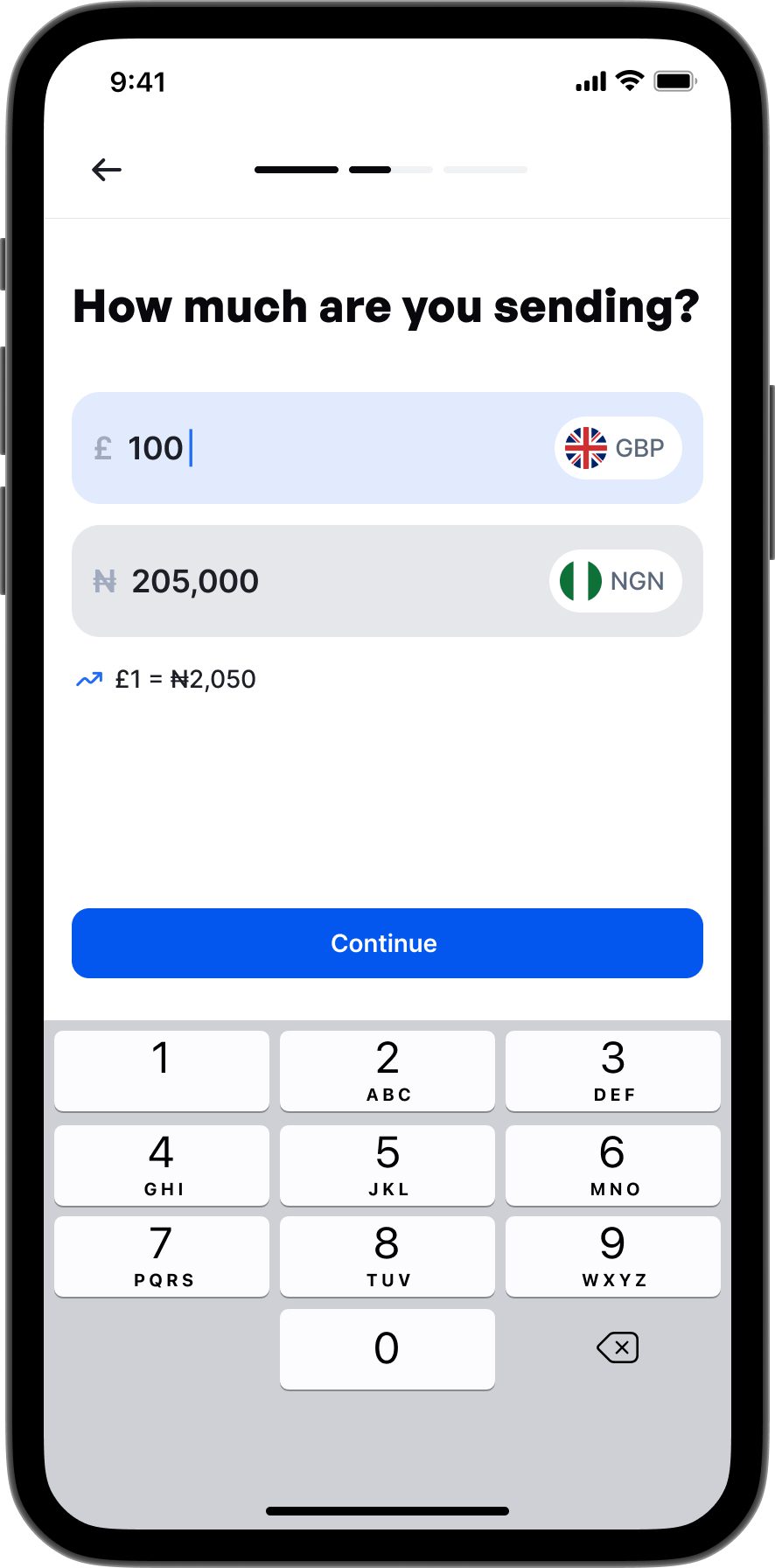

Moniepoint’s UK operations center on MonieWorld, a digital financial platform tailored for the African diaspora, particularly Nigerians living in the UK.

The service enables users to send money to Nigeria in as little as 17 seconds, offering competitive exchange rates and zero fees on transactions.

MonieWorld operates under Moniepoint GB, which acts as a distributor for PayrNet, a UK-authorized electronic money institution. This approach leverages the fact that remittances from the UK represent a substantial share of funds sent to Nigeria. In 2024, global remittance inflows to Nigeria grew by 9% year-over-year, with nearly half originating from the UK diaspora.

This insight underpins Moniepoint’s strategy: attract users by providing fast, transparent, and cost-effective services, then gradually expand the product portfolio. The current financial outlay is viewed as a strategic investment to build scale and network effects within the UK-Nigeria remittance corridor.

However, generating profits from remittance services is notoriously difficult. Margins are thin, regulatory demands are rigorous, and competition is fierce. Established remittance providers, challenger banks, and fintech platforms already operate in this space. To thrive, Moniepoint must differentiate itself not only through pricing and speed but also by fostering trust, ensuring compliance, enhancing user experience, and broadening its offerings to retain customers and increase market share.

Moreover, Moniepoint must navigate challenges such as currency volatility, timing mismatches in cash flow, regulatory capital requirements in both the UK and Nigeria, and the complexities of building brand recognition in a competitive market.

Leave a Reply