MTN MoMo Targets Seamless Cross-Border Payments Following $2.1 Billion Boom

In the first half of 2025, MTN’s mobile money service, MoMo, facilitated $2.1 billion in cross-border remittances across 14 African countries. This milestone highlights the progress of MTN Group Fintech, the financial services division of Africa’s largest telecommunications provider, in streamlining international payments. According to CEO Serigne Dioum, this achievement marks just the beginning of their ambition to create a seamless pan-African payment network.

“Our ultimate goal is to deliver financial services that are effortless, widely accessible, and secure,” Dioum shared in an interview with TechCabal. “We have developed a digital ecosystem that enables both individuals and enterprises to better control their finances and access vital services.”

Dioum emphasizes the need to rethink financial inclusion in Africa. “True inclusion is sustainable only when financial transactions become part of everyday life,” he said. “The narrative must move beyond mere access to financial tools, focusing instead on empowering people to build wealth and achieve economic independence.”

This evolving perspective is evident in recent data. Mobile money, once considered a simple payment method, has transformed into a powerful economic driver. The GSMA State of the Mobile Money Industry Report 2025 reveals that mobile money contributed approximately $190 billion to sub-Saharan Africa’s GDP in 2023, up from $150 billion the year before. In several regions, especially West and East Africa, mobile money now represents over 5% of GDP. Globally, the sector adds $720 billion to GDP, growing at a 12% annual rate.

For MTN MoMo, this growth presents a chance to reshape how Africans engage with financial services. With more than 283 million active mobile money users, $1.1 trillion in yearly transactions, and one-third of adults in sub-Saharan Africa utilizing mobile money, the platform is a cornerstone of the continent’s digital economy.

Creating an integrated fintech landscape

MTN’s fintech offerings have expanded well beyond person-to-person transfers. Its BankTech division delivers credit and savings solutions tailored for SMEs and large corporations, leveraging telecom and transaction data to instantly approve microloans and overdrafts. In the first six months of 2025 alone, MTN issued $1.3 billion in microloans, with an average loan size of around $20.

The MoMo merchant network has also seen rapid growth, now encompassing over 2 million merchants. From January to June 2025, these merchants handled transactions totaling $9.9 billion, underscoring MoMo’s vital role in facilitating daily commerce, Dioum noted.

Innovation remains central to MTN’s fintech vision. The MoMo OpenAPI platform, initially launched in Uganda, empowers fintech startups and developers to create new financial products using MTN’s infrastructure. This platform is now operational in all 14 markets, nurturing a vibrant community of local innovators.

Challenges on the path to a unified African financial system

Despite these advancements, the goal of a fully integrated financial ecosystem across Africa is still a work in progress. Dioum points out that over 350 million Africans remain unbanked, and cross-border money transfers continue to be costly, with fees averaging above 8% per transaction-among the highest worldwide.

“Africa’s financial services remain fragmented,” he explained. “Each nation operates its own payment rails, wallets, and standards. This fragmentation leaves many, especially underserved populations, behind-particularly when solutions prioritize smartphones over feature phones or offline access.”

To overcome these barriers, Dioum advocates for a fintech approach that prioritizes depth over scale. This means developing solutions that resonate with African realities, addressing gender disparities, enhancing digital literacy, safeguarding consumers, and promoting responsible lending practices that support financial well-being.

Balancing competition and collaboration in fintech’s new era

Africa’s fintech landscape is rapidly transforming, with telco-driven platforms like MoMo now competing alongside digital-native startups that craft hyper-localized products. Dioum views this rivalry positively. “Disruption is not a threat if anticipated,” he remarked. “It’s an opportunity to reinvent and evolve.”

Looking ahead to 2030, MTN envisions its fintech revenue shifting from basic peer-to-peer payments to more sophisticated services such as Buy Now, Pay Later (BNPL), MSME financing, investment options, and international transactions. The company is repositioning itself as a digital-first fintech platform focused on delivering intuitive, customer-centric experiences.

“In the future MoMo ecosystem, users won’t be confined to simple transactions,” Dioum said. “They will experience fully digital financial lives.”

Ensuring inclusivity for all users

A fundamental pillar of MTN’s strategy is to guarantee that digital progress includes those relying on Unstructured Supplementary Service Data (USSD)-a text-based system used on basic feature phones. “USSD remains crucial for deepening financial inclusion,” Dioum emphasized. “Our commitment is to leave no one behind.”

MTN’s extensive agent network plays a critical role in this mission by assisting customers with transactions and digital education. “These agents support individuals who may face language barriers or struggle with digital interfaces, bridging knowledge gaps to ensure everyone is included,” he added.

Dioum envisions a future where financial systems are truly interoperable within countries and across borders. “We must make cross-border trade and remittances as affordable and straightforward as local transfers,” he stated.

This vision also involves scaling digital payments for MSMEs, digitizing public services such as transportation and healthcare, and maintaining a coexistence of low-cost channels like USSD, feature phones, and mobile apps. It calls for collaborative regulatory frameworks, open data initiatives, and AI-powered fraud prevention to build consumer trust and safeguard users at scale.

“The decisions we make today will shape the next decade,” Dioum concluded. “Africa’s future hinges on bold, well-informed collaboration among governments, regulators, and innovators. When done right, mobile money will not only empower millions but also drive Africa’s digital transformation.”

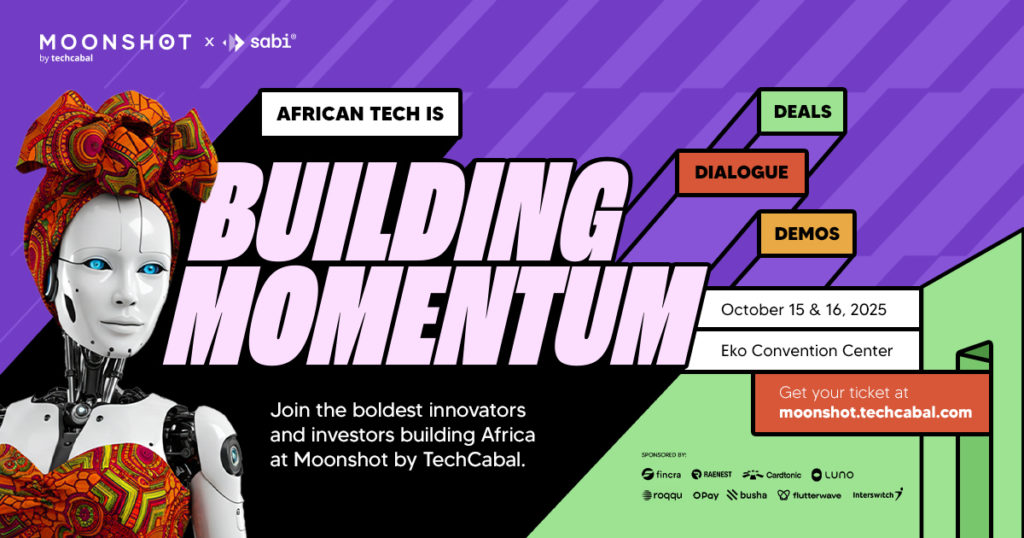

Save the date! Moonshot by TechCabal returns to Lagos on October 15-16! Join Africa’s leading founders, creatives, and tech visionaries for two days of inspiring keynotes, networking, and forward-thinking ideas. Secure your tickets now at moonshot.techcabal.com

Leave a Reply