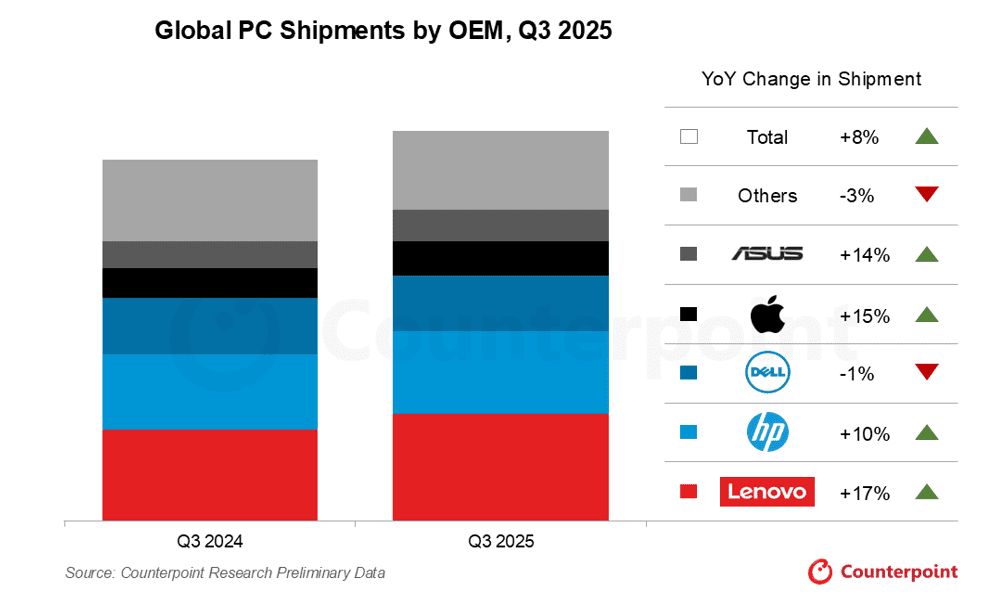

Global PC Shipments Soar 8.1% in Q3 2025 Driven by Windows 10 Sunset Boost

According to initial data from Counterpoint Research, worldwide PC shipments experienced a robust 8.1% year-over-year increase in the third quarter of 2025. This surge represents one of the most significant recoveries in the PC sector in recent times, driven by hardware refresh cycles, operating system upgrades, and strategic shifts within the market.

The primary catalyst behind this growth is the impending discontinuation of support for Microsoft Windows 10 scheduled for October 2025. As both businesses and individual users gear up for this transition away from the decade-old OS, demand for new devices has escalated globally. Counterpoint estimates that approximately 40% of active PCs still operate on Windows 10, highlighting the substantial impact this software phase-out has on hardware purchasing trends.

Additionally, modifications in U.S. import tariffs have led PC manufacturers to adjust their inventory management tactics, further accelerating shipment volumes. For the first time since 2021, the global PC industry appears to be emerging from a period of stagnation into a phase of consistent growth.

Lenovo Dominates; HP and Apple Make Notable Advances

Lenovo retained its position as the leading global PC manufacturer, achieving an impressive 17.4% year-over-year shipment increase in Q3 2025-the highest growth rate among the top six brands. Lenovo’s strategic balance between commercial and consumer markets, combined with effective channel distribution, enabled it to capitalize swiftly on the Windows 10 upgrade demand.

HP closely trailed Lenovo, posting a 10.3% annual increase, largely fueled by robust corporate fleet upgrades. Its strong foothold in enterprise and educational sectors helped HP maintain its global second-place ranking.

Conversely, Dell encountered a more subdued quarter. While shipments rose 2.7% sequentially, they declined 0.9% compared to the previous year, reflecting cautious spending patterns among enterprises in North America and Europe. Analysts attribute this to Dell’s significant exposure to the commercial segment, where hardware refreshes tend to be more measured.

Apple also recorded a solid quarter, with Mac shipments climbing 14.9% year-over-year. The surge was driven by high demand for the latest MacBook models, which feature enhanced M-series chips and energy-efficient designs. Counterpoint additionally observed a growing trend of enterprises adopting Apple devices as they diversify beyond traditional Windows environments.

Asus delivered one of the most remarkable performances, with shipments soaring 22.5% quarter-over-quarter and 14.1% year-over-year. This growth was propelled by strong consumer demand for notebooks and competitive pricing strategies. Asus’s aggressive expansion into gaming and creator-focused laptops proved highly successful during this period.

Together, Lenovo, HP, Dell, Apple, and Asus now command nearly 75% of the global PC market, underscoring ongoing consolidation that favors leading manufacturers. Smaller original equipment manufacturers (OEMs), lacking comparable scale and supply chain flexibility, experienced stagnant or declining shipment volumes.

The End of Windows 10 Paves the Way for AI-Driven PCs

Counterpoint’s Senior Analyst Minsoo Kang emphasized that the current surge is more than a temporary spike. “Although the immediate boost stems from the OS migration, the industry is on the cusp of a transformative era with the emergence of AI-powered PCs,” Kang explained. “However, this next phase of growth has yet to be fully reflected in the Q3 2025 data.”

The phase-out of Windows 10 is not only revitalizing PC sales but also setting the stage for a significant shift in personal computing: the advent of AI-integrated PCs.

Associate Director David Naranjo pointed out that the current upgrade cycle is as much about future readiness as it is about replacing outdated machines. “The 2025 PC market rebound isn’t solely about swapping old devices,” Naranjo noted. “It’s about equipping organizations for the future. Many companies are investing in AI-capable PCs to ensure their fleets remain relevant, even if immediate AI use cases are limited.”

Manufacturers are increasingly promoting new models featuring neural processing units (NPUs) and on-device AI acceleration. These innovations enable PCs to run AI assistants, large language models, and generative AI applications locally, reducing dependence on cloud services. For now, these capabilities serve more as a future-proofing advantage than a primary reason for purchase.

Currently, buyers prioritize practical considerations such as operating system compatibility, enhanced performance, and battery longevity. Nonetheless, the momentum toward AI-ready hardware is unmistakable. Businesses are opting for PCs capable of handling AI workloads-not necessarily for immediate use, but to avoid obsolescence.

While AI-enabled PCs have begun entering the market, experts anticipate a significant expansion starting post-2026. This growth will coincide with the release of next-generation processors specifically designed for AI tasks.

Qualcomm has introduced its Snapdragon X2 Elite PC processor, which integrates advanced NPUs optimized for continuous on-device AI processing.

Intel is preparing its “Panther Lake” Core Ultra series, featuring enhanced neural acceleration. Meanwhile, NVIDIA, collaborating with MediaTek and other chipmakers, is developing ARM-based CPUs with integrated GPU AI engines tailored for PC performance.

Counterpoint forecasts that widespread adoption of these AI-focused processors will gain momentum by late 2026, with broader consumer availability expected in 2027. Consequently, the AI PC revolution is projected to accelerate in the latter half of the decade.

By that time, AI integration is anticipated to transform user-device interactions, shifting emphasis from raw computing power to intelligent, edge-based capabilities.

Industry analysts predict that CES 2026 will unveil a new generation of AI-enabled PCs, signaling the official beginning of this transformative computing era.

For now, 2025 serves as a crucial transitional year, marked by the replacement of aging hardware, the conclusion of Windows 10 support, and the foundational steps toward AI-enhanced personal computing.

As Kang succinctly put it, “This refresh cycle is about laying the groundwork for a revolution. What lies ahead will be the most significant advancement in the PC industry since the notebook’s inception.”

Leave a Reply