Why Strong Crypto Regulation Is Essential to Protect Against Bad Actors

The surge in cryptocurrency usage across Nigeria highlights a growing recognition of digital currencies as a cornerstone for the future of financial transactions. As more Nigerians engage with crypto assets, industry experts emphasize the urgent need for regulatory frameworks to safeguard the market from fraudulent activities.

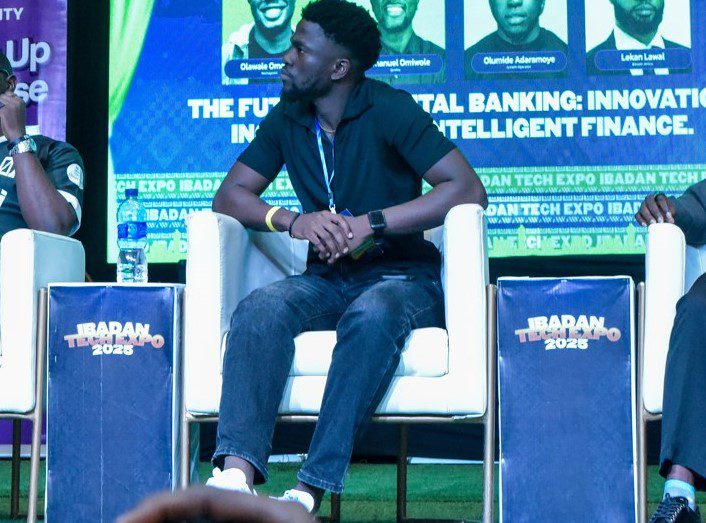

At the Ibadan Tech Expo, Emmanuel Omiwole, a Performance Marketing Specialist at Quidax, shed light on the Securities and Exchange Commission’s (SEC) efforts to regulate the digital currency space. He stressed that such oversight is essential in a nation experiencing rapid growth in crypto participation.

“Innovation cannot thrive without a regulatory foundation. Regulations serve to exclude malicious actors from the ecosystem, ensuring a safer environment for all participants,” Omiwole remarked.

Between July 2023 and June 2024, Nigeria’s cryptocurrency market recorded transactions totaling approximately $59 billion, positioning the country as the world’s second-largest crypto adopter after India. A report published in August 2025 by Breet revealed that 85% of these transactions were below $1 million, indicating robust engagement from retail investors.

In response to these figures, the SEC has intensified efforts to regulate the crypto sector and eliminate Ponzi schemes through the implementation of the Investment and Securities Act (ISA), a significant milestone in enhancing the commission’s regulatory capabilities.

Omiwole also highlighted a common reluctance among crypto traders and innovators to engage with government regulations, fearing that such policies might stifle creativity or exclude them from the market.

Over the past decade, the global financial landscape has been transformed by digital assets, with countries like El Salvador and the Central African Republic officially recognizing cryptocurrencies as legal tender. Nigeria, meanwhile, has witnessed exponential growth in the number of crypto users, investors, and trading platforms.

According to the Breet report, approximately 22 million Nigerians-about 10.3% of the population-owned cryptocurrencies as of August 2025, a dramatic increase from just 0.4% ten years prior. This surge underscores the expanding footprint of digital assets within the Nigerian economy.

Related Read: Tinubu’s push for crypto education: The need for clear policies before judicial training – Expert

Blockchain’s Role in Enabling Instantaneous Transfers

In August 2024, the SEC granted “Approval-in-Principle” licenses to two digital asset exchanges-Quidax Technologies Company and Busha Digital Limited-marking Nigeria’s inaugural crypto licensing initiative. Despite regulatory actions against major international exchanges like Binance and OKX earlier that year, the SEC demonstrated openness to partnering with indigenous crypto firms.

The ARIP regulatory framework governs virtual asset service providers and token issuers operating within Nigeria or serving Nigerian clients. This includes platforms facilitating the issuance, trading, custody, and transfer of digital assets.

Omiwole emphasized that blockchain technology presents a significant opportunity for commercial banks to revolutionize their payment infrastructures. By removing intermediaries, automating workflows, and leveraging a transparent, decentralized ledger, banks could achieve near-instant transaction settlements.

For example, cross-border payments currently require several hours to process. The integration and regulation of digital currencies could streamline these transactions, enabling faster and more efficient international transfers.

However, realizing this vision depends on effective collaboration between the Central Bank of Nigeria (CBN), which oversees monetary policy, and the SEC, responsible for capital market regulation.

“There is some uncertainty about the respective roles of the CBN and SEC in this space, but ultimately, they must find common ground and work together rather than competing,” Omiwole added.

For now, the SEC continues to refine its regulatory approach to strike a balance that will enable the Nigerian financial system to embrace digital assets within mainstream banking operations.

Leave a Reply