Brewers see biggest cut in FX loss on naira rally

Brewers in Africa’s most populous nation are heaving a sigh of relief as their net foreign exchange loss saw a big drop in the nine months to September 2025, helped by a firmer naira that’s become more predictable and offsetting FX pressures on corporate earnings.

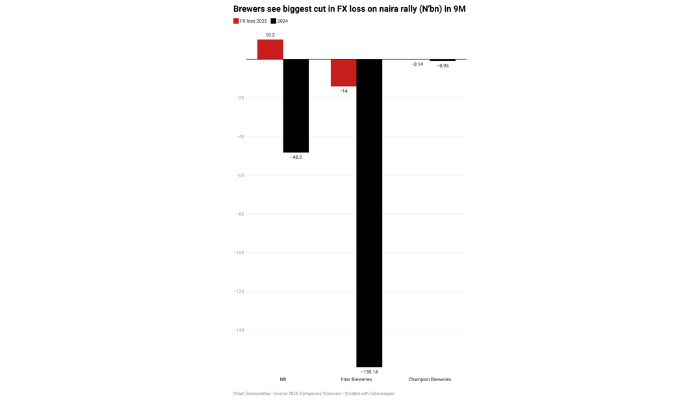

Nigerian Breweries, International Breweries, and Champion Breweries have had to contend with foreign exchange losses due to the volatility witnessed last year, but a stable naira is changing that narrative, with the brewers cutting combined FX losses by 98.35 percent to N3.44 billion in the reviewed period.

Nigerian Breweries is the only standout performer as the firm swings from N48.2 billion in FX losses last year to a net gain of N10.26 billion by the end of September.

The foreign exchange market reforms in June 2023 led to a sharp devaluation of the Naira, from an average of N400/USD to roughly N900/USD by year-end. The resulting currency adjustment had far-reaching implications for the real sector, with the consumer goods industry — particularly breweries — among the hardest hit.

One of the immediate effects was a steep rise in raw material costs, given the industry’s reliance on imported inputs such as barley, which further eroded margins. The sharp depreciation also had a material impact on earnings, as brewers reported record foreign exchange losses on USD-denominated loans, payables, and letters of credit.

By the end of 2023, brewers’ FX losses surged to N255.32 billion compared to N40.04 billion in the same period in 2022, pushing all players into a loss position.

The pressure intensified in 2024 as the Naira weakened further to an average of N1,540.70/USD, resulting in another year of aggregate sector losses — totaling N221.50 billion compared to N255.32 billion in 2023.

Read also: How brewers are navigating Nigeria’s volatile market to sustain growth

Nigerian Breweries

Historically, Nigerian Breweries’ finance costs have remained relatively stable. However, a significant shift occurred by the end of 2023 as finance costs surged by 331.81 percent year-on-year to N36.37 billion.

The spike was primarily driven by increased borrowings — N360.53 billion in new loans, a N110.14 billion commercial paper issuance, and an intercompany loan of N63.28 billion — substantially raising interest obligations.

Additionally, the company incurred an exchange loss of N153.33 billion in the 2023 full year compared with N26.34 billion in 2022, reflecting the sharp depreciation of the Naira during the year.

Despite a 67.31 percent year-on-year (Y-O-Y) reduction in loans and borrowings, finance costs rose further in the 2024 full year, up 173.49 percent YoY to N99.46 billion, owing to the continued impact of FX volatility.

Exchange losses remained elevated at N157.59 billion, as the naira depreciated further against the dollar. However, finance income rose significantly to N4.24 billion compared to N513.24 million in 2023, owing to a rise in interest on bank deposits.

By the end of nine months 2025, improved FX market stability following ongoing reforms led to a 45.66 percent YoY decline in finance costs to N38.15 billion compared to N230.04 billion.

This was further supported by an 18.86 percent reduction in loans and borrowings to N137.17 billion compared to N169.06 billion, following the deployment of its rights Issue proceeds to repay part of its debt. This led to an 85.5 percent reduction in net finance cost in 9M:2025, to N33.66 billion from N232.04 billion in the prior period last year.

Notably, since persistent FX losses were a major contributor to the company’s net losses in 2023 FY and much of 2024 FY, the relative stability of the exchange rate in 2025 (averaging NGN1,530.18 in 9M:2025) supported a turnaround in 9M:2025 by reducing FX-related expenses.

This is evident in the firm’s switch to a net foreign exchange gain position of N10.25 billion from its previous net foreign exchange loss position of N48.21 billion in 9M:2024, supporting the company’s bottom line performance.

The company has maintained strong profitability over the years, except for the 2023 full year, where it posted N106.31 billion, and 2024 at N144.88 billion, when earnings were pressured by significant foreign exchange volatility.

The company returned to profitability in the first quarter of 2025 and maintained this momentum into 9M:2025, with a 157.20% YoY improvement in net income to N85.51 billion, compared to a N149.50 billion loss last year.

This rebound also supported a recovery in key profitability indicators, with net margin, Return on Assets (ROA), and Return on Equity (ROE) rising to 8.17 percent, 7.70 percent, and 15.64 percent, respectively, compared to 21.03 percent, 15.07 percent, and 173.13 percent in the corresponding period.

“Overall, we project a sustained recovery in profitability, with earnings expected to improve meaningfully from the FX-induced losses of prior years. Also, continued exchange-rate stability, further optimisation of financing costs, and stronger operating fundamentals are expected to be the key drivers of this rebound,” analysts at Lagos-based consultancy Meristem Research said in a report.

Read also: Brewers to FG: Tax stamps rollout could worsen inflation

International Breweries

International Breweries slashed its FX losses from N159.14 billion in the 9M period last year to N13.5 billion, reflecting a 91.52 percent drop as the company rides on improving FX position to lift margins.

The brewer posted losses for five straight years, with the deficit deepening to N21.63 billion in 2022 and extending further into 2023 at N70.03 billion and 2024 full year at N113.61 billion. However, performance improved significantly in 9M:2025, as the company reported a profit after tax of N57.83 billion, compared with a loss of N112.81 billion in 9M:2024.

This recovery was supported by the sharp drop in finance costs and a substantial decline in other expenses – 98.79 percent YoY, driven by lower foreign exchange losses following improved FX stability during the year and the reduction in FCY obligations in 2024FY.

Consequently, profitability metrics rebounded strongly, with net margin, ROA, and ROE rising to 12.24 percent, 8.11 percent, and 11.41 percent, respectively, compared to 32.85 percent, 16.35 percent, and 25.41 percent in the nine months last year.

For context, over the last five years, net margin, ROA, and ROE have averaged 17.42 percent,8.99 percent, and 32.47 percent, reflecting the company’s prolonged loss-making position.

“In our view, INTBREW’s profitability is set to strengthen further, supported by easing FX pressures that are expected to keep finance costs in check, alongside a gradually improving operating environment, factors that collectively bode well for earnings,” analysts at Meristem Research said.

Champion Breweries

For Champion Breweries, finance costs have increased steadily over the past three years, driven mainly by interest payments on lease liabilities, employee-related obligations, and, more recently, exchange differences on foreign-currency (FCY) letters of credit and interest on loans.

Hence, finance costs rose by 45.59 percent YoY in 2023FY and surged by 529.47 percent by the end of 2024. This sharp escalation was primarily due to higher exchange losses on FCY letters of credit, which climbed to N708.43 million in 2024FY from N55.89 million in 2023, alongside increased interest expenses on loans up to N237.23 million from N151.78 million.

In 9M:2025, finance expenses surged by 67.79x YoY to N1.38 billion from N20.03 million in 9M:2024, following the drawdown of new loan facilities totaling N13.48 billion compared to a zero loan balance in the prior period.

Notably, net foreign exchange losses declined sharply by 85.14 percent to N140.54 million from N945.66 million in the same period last year, supported by improved FX stability over the period. The company also earns finance income on mostly short-term deposits, which helped offset part of the finance costs, thereby softening the net finance cost burden.

Despite the tough cost environment, the Uyo-based brewer has continued to deliver solid bottom-line performance, maintaining profitability every year since 2019. Although profit after tax fell sharply in 2023FY, down by 73.68 percent to N370.56 million from N1.41 billion in 2022FY, largely due to sizeable foreign exchange losses, the company recorded a strong rebound in 2024FY.

Net profit rose by 120.47 percent to N817.00 million, supporting improvements across key profitability indicators: net margin, ROA, and ROE expanded to 3.91 percent, 3.90 percent, and 7.03 percent, respectively, from 2.92 percent, 2.06 percent, and 3.32 percent in 2023FY.

Performance strengthened even further in 9M:2025, when Champion Breweries delivered its highest earnings on record, posting a net income of N2.05 billion compared to N21.50 million in 9M:2024.

As a result, net margin, ROA, and ROE rose markedly to 9.54 percent, 5.55 percent, and 15.08 percnt, respectively, compared to 0.15 percent, 0.12 percent, and 0.19 percent last year.

“Going forward, we anticipate the company’s profit trajectory to remain on an uptrend, with 2025FY PAT projected at NGN3.12bn. This outlook reflects a gradual easing of FX volatility, moderating inflationary pressures, and continued revenue growth, which together should support further margin expansion over the forecast period.”

Leave a Reply