CBN pushes new financial inclusion strategy to power economic growth

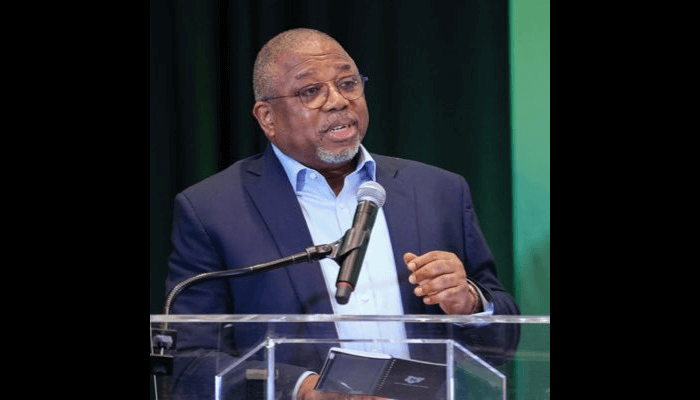

Philip Ikeazor, the Central Bank of Nigeria’s Deputy Governor for Financial System Stability, said financial inclusion must remain a core priority in the nation’s economic transformation agenda, reaffirming that the next phase of CBN reforms will be crucial for driving growth, stability, and poverty reduction.

Represented by Aisha Issa Olatinwo, director of consumer protection and financial inclusion at the 9th Annual Financial Markets Conference organised by the Financial Markets Dealers Association, Ikeazor noted that the connection between financial inclusion, economic stability, and national growth is now clearer than ever, describing inclusion as a fundamental pillar for improving livelihoods.

“Every individual should be able to access secure and reliable financial services with the potential to increase prosperity, reduce poverty, and enable social well-being,” he said.

Despite progress over the past decade, particularly the rising adoption of digital wallets, bank accounts, and formal financial channels, he acknowledged that key barriers persist. Rural and low-income populations still face challenges such as limited access points, low financial literacy, infrastructure gaps, and regulatory constraints.

Read also: CBN clarifies NRBVN charges for Nigerians in diaspora, reaffirms commitment to financial inclusion

Ikeazor highlighted improvements recorded between 2012 and 2023, including declines in the number of adults depending solely on informal financial systems, but warned that more work is required to close remaining access gaps.

He reaffirmed the apex bank’s commitment to accelerating reforms under the National Financial Inclusion Strategy, which is currently being updated to its next phase, NFIS 4.0.

The revised framework, he said, will focus on strengthening digital channels, deepening credit access, and ensuring underserved groups are better supported.

“Policy remains at the heart of our efforts,” he noted. “We have implemented a range of initiatives from the original strategy to the current version under review, which will come out as NFIS 4.0.”

According to Ikeazor, technology remains the most powerful driver of inclusion. Digital financial services ranging from mobile wallets to fintech-enabled credit are breaking old barriers and enabling millions to access services previously out of reach.

He added that the CBN is working to ensure a safe digital environment by prioritising cybersecurity, consumer protection, and responsible innovation.

He also outlined how financial inclusion fuels economic expansion: improved credit access, greater participation in the economy, increased savings and investment, stronger resilience to shocks, and more opportunities for job creation and poverty reduction.

Read also: CBN’s new agent banking rules tighten Nigeria’s financial inclusion drive (Part 1)

“Financial inclusion can help reduce income inequality and grow the economy to its full potential,” he said.

The Deputy Governor stressed that collaboration across stakeholders, regulators, financial institutions, fintech innovators, civil society, and development partners will determine the success of Nigeria’s inclusion agenda.

“Achieving our vision requires collaboration across governments, regulators, financial institutions, technology developers, civil society and the public,” he said, urging stakeholders to recommit to building a resilient and future-proof financial system.

He added that Nigeria’s youthful demographics and rapid digital adoption present a significant opportunity to achieve near-universal financial inclusion in the coming years.

Leave a Reply