BOI, NCGC launch N10bn loan scheme to empower women-owned businesses

The Bank of Industry (BOI) and the National Credit Guarantee Company (NCGC) have launched a ₦10 billion loan scheme aimed at expanding access to affordable financing for women-owned businesses across Nigeria, marking a major push to strengthen women’s economic empowerment and scale their participation in high-growth sectors.

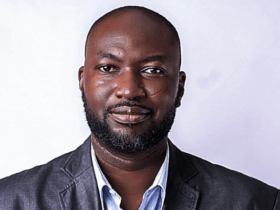

According a statement by the bank, the initiative, anchored by Olasupo Olusi, Managing Director/CEO, BOI is designed to remove long-standing financing barriers faced by women entrepreneurs and stimulate inclusive growth in high-impact sectors.

Signed on Wednesday in Abuja, the Memorandum of Understanding (MoU) establishes a credit-guarantee framework under which NCGC will provide a 25 percent guarantee cover on BOI loans, significantly reducing lender risk and enabling broader access to affordable financing for women-led MSMEs.

Read also: World Bank, BOI chart new development finance model to spur investment, job creation

Olusi, who signed on behalf of BOI, described the new Guaranteed Loans for Women (GLOW) programme as a deliberate national intervention to close systemic gender-financing gaps.

“Today’s event represents more than a procedural milestone; it signals our collective commitment to expanding access to finance for the Nigerian entrepreneurs who power our economy, particularly women and MSMEs,” he said.

He noted that the ₦10 billion facility was designed with concessionary interest rates of seven percent, flexible collateral provisions, and embedded capacity-building support to ensure women not only access funding but are equipped to scale their businesses sustainably.

One of the strongest validations of the programme’s relevance, he added, is the overwhelming response from the market.

“We have recorded over 33,000 applications in progress, with an estimated value exceeding ₦65 billion. This level of demand demonstrates the depth of entrepreneurial activity among Nigerian women and the urgent need to scale programmes such as GLOW,” Olusi stated.

He emphasised that NCGC’s participation, beginning with a ₦5 billion guarantee envelope is vital for responsibly extending credit and reaching viable but previously underserved women-led enterprises restricted by collateral requirements.

According to NCGC, the guarantee cover will allow women-owned businesses to access loans at lower rates and with shorter approval timelines. Beneficiaries will also receive mentorship, advisory support, and capacity-building programmes to strengthen their operational capacity.

The initiative targets key sectors such as manufacturing, processing, ICT, digital services, e-commerce, creative industries, healthcare, education, renewable energy, and waste management.

Olusi further stressed that the programme aligns with national priorities on financial inclusion, MSME development, productivity expansion, and the Federal Government’s broader credit reform agenda.

He commended the NCGC leadership for its commitment to building a more resilient credit ecosystem and acknowledged the BOI teams whose groundwork made the initiative operational.

Reaffirming BOI’s long-term commitment, he said, “Our shared objective is to empower women, strengthen MSMEs, create jobs, and unlock the productive potential of our economy.”

Bonaventure Okhaimo, Managing Director, NCGC said the company remains committed to enabling responsible credit expansion and supporting inclusive economic development.

By reducing lending risks, he noted, NCGC is helping more women entrepreneurs access the capital and resources needed to thrive.

He added that the company will continue to drive a stronger, more inclusive financial ecosystem where women-led businesses play a central role in Nigeria’s economic transformation.

Leave a Reply