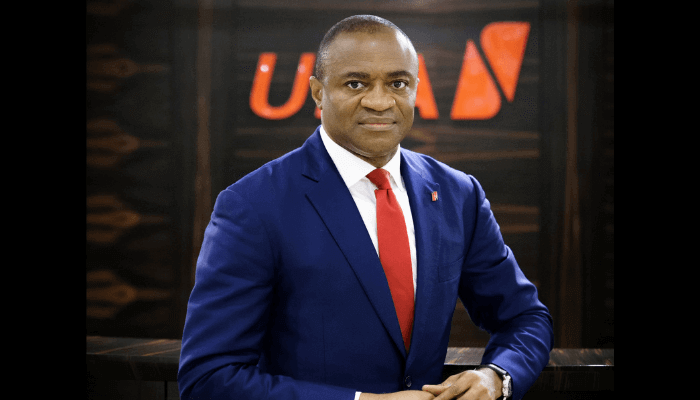

There is no forbearance loan in UBA books – Alawuba

Oliver Alawuba, group managing director/Chief Executive Officer, UBA Plc has disclosed that the bank is out of any form of forbearance loans.

Forbearance is a temporary arrangement, typically with a lender, to lower or suspend loan payments for a set period due to financial hardship, allowing the borrower to resume payments once his financial situation improves.

The CBN in June directed banks to temporarily suspend the payment of dividends to shareholders, defer the payment of bonuses to directors and senior management staff. The apex bank also asked banks to refrain from making investments in foreign subsidiaries or embarking on new offshore ventures.

“There is no forbearance loan in UBA books. CBN has already approved the payment of dividend which will be paid in next couple of days,” the CEO said on Tuesday during the bank’s investor conference call. UBA said that some of the write-off for forbearance were taken off before H1’25 and finally erased in H1, which made it have less impact on its profitability.

Read also: UBA cuts interim dividend despite strong half-year earnings

The CBN justifies the measures as necessary to strengthen capital buffers, enhance balance sheet resilience, and ensure prudent internal capital retention during this transitional period. The apex bank noted that suspension will remain in effect until banks fully exit regulatory forbearance and demonstrate compliance with capital adequacy and provisioning standards through independent verification.

Alawuba, who led the bank’s excos in responding to questions from participants at the conference further said, “It is important to note that UBA tries to ensure that we remain competitive on the total dividend yield for the year.”

The bank CEO noted that the CBN has also approved its dividend payment for the half year (H1). The Africa’s global bank recently released its financial performance for the half-year (H1) ended June 30, 2025, posting a N335 billion in profit after tax (PAT).

The audited financials released to the Nigerian Exchange Limited (NGX) showed a remarkable growth across its major business segments, driven by strong earnings.

The bank recorded significant growth in its gross earnings and profit after tax, signalling robust balance sheet expansion.

Speaking on the capital raising and its deployment, he said, “the second round of the right issue was very attractive,” adding that they bank is waiting for regulatory approval for the capital raise.

The bank had raised N234billion in its first capital raise. It just concluded the second capital raise –rights issue of N154billion, which it hopeful of raising as it awaits regulatory approvals.

He’s optimistic that the price of the shares of UBA will reroute north after the rights issue. The bank used the opportunity to disclose its revised growth guidance which include: deposit (20 percent), and loan (10 percent). Alawuba also noted that UBA committed to building Africa’s global bank.

At the end of the first two quarters of the year, and despite the tough global macroeconomic climate in Nigeria and major countries in Africa where the bank operates, UBA’s gross earnings grew by 17.28 percent, rising from N1.371 trillion in June 2024 to N1.608 trillion in the period under review.

Interest income also increased by 32.89 percent from N1.003 trillion in June last year to N1.334 trillion, while total assets went up by 9.71 percent to N33.3 trillion up from N30.3 trillion recorded in December 2024. Total Customer deposits also leapt by 11.9 percent in the same period to close at N27.6 trillion up from N24.6 trillion recorded at the end of 2024.

The results also showed that profit after tax which stood at N316.36 billion in June 2024, rose by 6.06 percent to close the half year at N335.53 billion, while profit before tax dropped slightly from N401 billion to N388 billion in the period under consideration. However, the banks’ shareholders’ funds remained strong as it increased by 23 percent from N3.41 trillion in December 2024, to N4.22 trillion in June 2025.

Leave a Reply