Fintechs Surge Ahead, Leaving Banks’ Digital Earnings in the Dust and Transforming the Financial Landscape

Nigerian banks are encountering challenges in the digital payments sector, with electronic channel revenues declining by 3.7% in the first half of 2025. This downturn highlights the rising dominance of fintech firms alongside persistent issues with service reliability.

Analysis of the mid-year financial statements from seven publicly listed banks reveals a mixed performance. While institutions like FCMB Group, Zenith Bank, Guaranty Trust Holding Company (GTCO), and United Bank for Africa (UBA) reported declines in digital income, others such as First HoldCo, Stanbic IBTC Holdings Plc, and Sterling Financial Holding Company experienced growth.

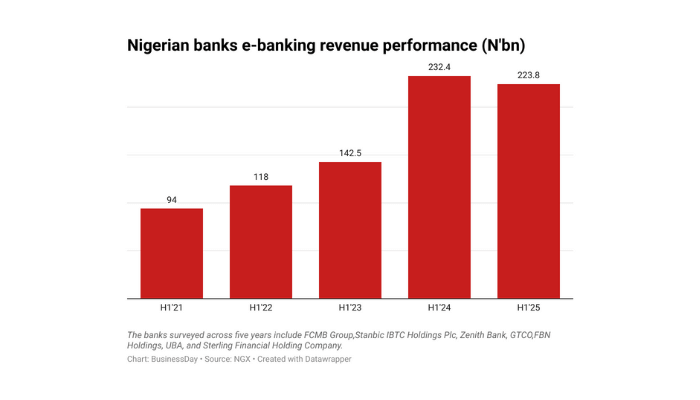

Overall, these banks amassed N223.8 billion in digital revenues during the first half of 2025, a decrease from N232.4 billion recorded in the same period last year.

Industry specialists attribute this uneven outcome to prolonged network disruptions, regulatory hurdles, and mounting competition from agile fintech startups.

Olumide Sole, head of Financial Institutions Research at Renaissance Capital Africa, pointed out that many banks faced system downtimes during critical platform upgrades.

“When these outages occurred, customers quickly migrated to fintech platforms, which offered uninterrupted and reliable services. Fintechs didn’t gain traction by accident; they simply provided a superior user experience,” he remarked.

Banks Facing Revenue Declines

BusinessDay’s data reveals that FCMB Group, GTCO, Zenith Bank, and UBA experienced digital revenue drops of 30%, 12%, 11.8%, and 5.2%, respectively.

This reduction in electronic revenue streams raises questions about these banks’ capacity to adapt and prosper in an increasingly digital financial environment.

Digital channels have traditionally been crucial for banks, often cushioning the impact of shrinking interest income. Analysts warn that a sustained decline could further squeeze profit margins amid rising operational expenses.

“Nigeria’s payment ecosystem is becoming fiercely competitive. Although banks still dominate in transaction value, fintech companies are rapidly overtaking them in transaction volume and customer engagement,” Sole added.

On the other hand, FirstHoldCo (up 25.1%), Stanbic IBTC (4.65%), and Sterling HoldCo (2.78%) benefited from the Central Bank of Nigeria‘s (CBN) revised withdrawal fee policy.

The CBN explained that these fee adjustments are part of comprehensive reforms designed to better align transaction charges with actual operational costs, as detailed in a circular signed by John S. Onojah, acting director of Financial Policy and Regulation.

Consequences of Service Disruptions

Between Q3 2024 and Q1 2025, several Nigerian banks, including GTB and Wema, undertook significant core banking system upgrades aimed at modernizing their infrastructure and enhancing customer experience.

However, a senior information security professional at a top Nigerian bank, speaking on condition of anonymity, revealed that aggressive deadlines set by CEOs to minimize costs often lead to technical glitches during these upgrades.

“Compressed timelines make it difficult to avoid errors and security risks, while prolonging the upgrade process only inflates costs,” the expert explained.

Social media users, such as Daba Omoregbee, voiced dissatisfaction over failed transactions and inadequate communication during these downtimes, calling for improved customer support.

The CBN has consistently expressed concern over frequent banking platform outages, which cause failed transfers, delayed reversals, and inaccessible mobile applications, ultimately eroding consumer confidence. Each disruption results in lost transaction volumes and diminished digital income.

“Dependability in service delivery has become a key competitive advantage. When banks experience outages, fintech providers like Opay, PalmPay, and Moniepoint become the immediate alternatives. Customers no longer wait; they switch instantly,” noted a Lagos-based payments consultant.

Fintechs Driving the Payment Transformation

Data from the Nigerian Interbank Settlement System (NIBSS) shows that mobile money transaction values surged by 20.3% to N20.7 trillion in Q1 2025, up from N17.2 trillion in Q1 2024.

For many Nigerians, fintech apps have become the go-to solution for everyday financial tasks such as bill payments and peer-to-peer transfers. This trend is reflected in the financial results of leading fintech companies.

Kuda Technologies, a major digital bank in Nigeria, reported processing N14.3 trillion across more than 300 million transactions in Q1 2025.

CEO Babs Ogundeyi revealed that retail banking users contributed N8.5 trillion, while business clients accounted for N5.8 trillion.

Transfers, mostly free for users, remain the platform’s primary activity. Business banking alone recorded N1.5 trillion in transfers. Notably, the bank observed an increase in paid transfers compared to free ones, signaling Nigerian consumers’ growing readiness to pay for convenience.

Bank-Backed Fintech Growth

Fintech initiatives affiliated with banks, such as GTCO’s HabariPay and Access Hydrogen, have also secured substantial market shares.

Access Hydrogen’s after-tax profit soared by 466% to N283 million in Q1 2025, compared to N50 million in the same quarter of 2024.

Similarly, GTCO’s HabariPay saw its profit multiply twelvefold over three years, reaching N4.02 billion in H1 2025 from N322.9 million in H1 2022, according to GTCO’s half-year financial report.

Leave a Reply