South African Luno Users Can Now Shop with Crypto at Top Retailers!

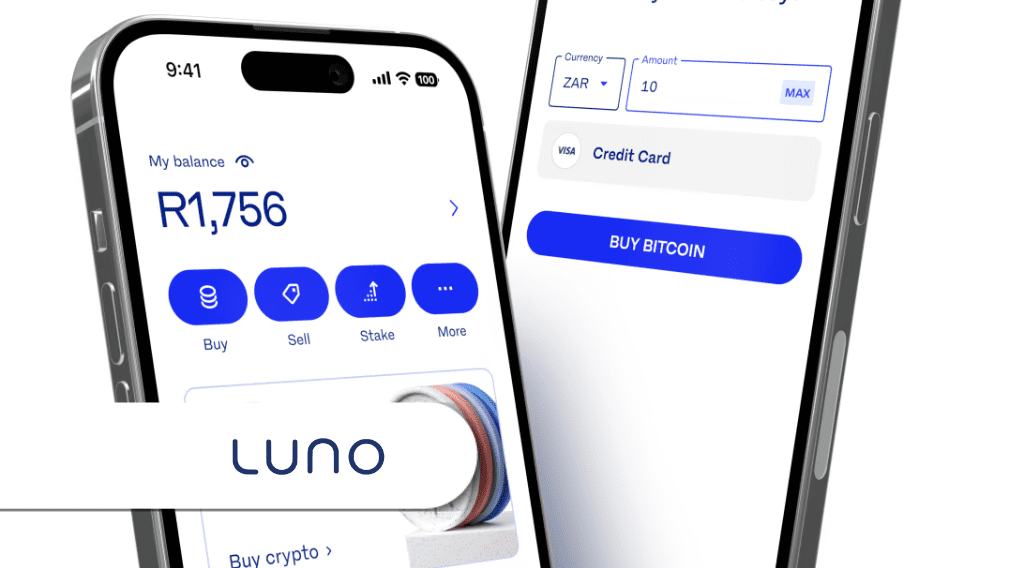

Users of Luno in South Africa can now make purchases using cryptocurrency at prominent retailers such as Shoprite, Checkers, Makro, and Vodacom. Thanks to the expansion of Luno Pay, nearly 700,000 retail locations nationwide are integrated with Scan to Pay technology, enabling customers to pay with Bitcoin or Tether simply by scanning a QR code.

Through a collaboration with MoneyBadger, Luno has made it possible for merchants to accept crypto payments without altering their existing payment infrastructure. Shoppers just scan a QR code via the Luno app, pick their preferred cryptocurrency, and approve the transaction.

Since its debut in November 2024, Luno Pay has processed over 48,000 transactions amounting to more than R28 million across 1,600 merchants. The fact that 70% of users return indicates a growing trend in South Africa where Bitcoin is increasingly used for everyday spending rather than just as an investment asset.

Bringing cryptocurrency into everyday shopping

The merger of Luno Pay’s 30,000 outlets with Scan to Pay’s 650,000 locations dramatically broadens the acceptance of cryptocurrency payments throughout South Africa, now including major retail chains for seamless nationwide crypto transactions.

To encourage the use of USDT, customers who pay with this stablecoin can earn up to 10% cashback in USDT. This rewarding incentive is designed to boost the adoption of cryptocurrency payments by offering immediate, tangible benefits that promote familiarity and trust in digital currencies.

Meanwhile, merchants enjoy a hassle-free integration that fits smoothly with their current payment systems. This effortless setup reduces operational interruptions while unlocking the advantages of accepting USDT payments.

This approach allows businesses to tap into the expanding demographic of crypto-savvy consumers and optimize their payment processing. The instant rewards further enhance the appeal, creating a win-win environment for both shoppers and retailers.

MoneyBadger CEO Carel van Wyk anticipates that this initiative will motivate more frequent Bitcoin spending, shifting its role from a speculative asset to a practical currency. Luno’s country manager, Christo de Wit, views this as a pivotal move toward mainstream cryptocurrency adoption, enabling users to spend digital assets and receive instant rewards at any participating store, thereby embedding crypto into daily commerce.

With this integration, Luno Pay establishes itself as a frontrunner in South Africa’s cryptocurrency payment landscape. The network connects hundreds of thousands of merchants, facilitating widespread digital currency usage. Consumers benefit from effortless crypto payments, while merchants can accept these without needing to overhaul their systems.

Also read: Luno introduces tokenized global stock trading in Nigeria

The platform’s rapid growth underscores the increasing practicality of cryptocurrency, enabling users to transact and access services with digital assets. As more merchants adopt crypto payments, digital currencies will become further embedded in everyday financial activities.

Simplifying payments for both consumers and merchants

At checkout, customers scan a QR code, select Bitcoin or Tether, and confirm their payment, mirroring the convenience of popular mobile payment apps. Merchants receive funds instantly and can convert them into local currency, streamlining their financial operations.

Luno Pay’s growth also promotes financial inclusion by enabling crypto payments for goods and services, especially benefiting individuals without access to traditional banking. The increasing number of merchants accepting digital currency helps normalize its use for everyday purchases.

The surge in transaction volume and speed directly reflects the growing adoption of cryptocurrency. Faster processing times and higher throughput strengthen the overall crypto network, enhancing its reliability and efficiency.

By incentivizing daily crypto spending, the platform encourages the transition of digital currencies from speculative assets to practical tools for economic activity, fostering sustained user engagement through rewards.

Merchants can continue using their existing point-of-sale systems, minimizing disruption while adopting cryptocurrency payments. This seamless integration is vital for broader acceptance, showcasing crypto’s viability as a practical alternative to conventional payment methods.

For digital currencies to become mainstream financial instruments in South Africa, increasing public awareness and simplifying usage are essential. Educating consumers about the benefits and functionalities of digital currencies will be key to encouraging widespread adoption of this innovative payment solution.

Leave a Reply