PoS Operators Now Required to Streamline Operations with a Single Terminal

The Central Bank of Nigeria (CBN) has introduced a new regulation requiring Point-of-Sale (PoS) agents to affiliate exclusively with a single financial institution. This directive is part of the updated agent banking framework recently unveiled by the CBN.

In a circular published on Monday titled ‘Guidelines for the Operators of Agent Banking in Nigeria,’ the CBN emphasized that this policy aims to enhance the resilience and integrity of Nigeria’s financial ecosystem. The move comes amid a rapid expansion of PoS agents following the COVID-19 pandemic.

“Considering the broad scope of the agent banking sector and the increasing complexity driven by technological progress, it was imperative for the CBN to update the regulatory framework to reflect current market dynamics,” the document states.

According to the new rules, each PoS agent must be directly appointed by a single financial institution and is permitted to provide agent banking services exclusively for that institution during a defined period. This means operators who previously utilized multiple platforms to serve customers must now select one from among commercial banks, non-interest banks, payment service banks, microfinance banks, mobile money operators, or super agents.

To clarify, PoS agents who currently operate multiple terminals from different providers-such as OPay, Moniepoint, Smartcash, MomoPSB, Kuda, Nomba, and Palmpay-are now required to consolidate their operations under a single terminal provider.

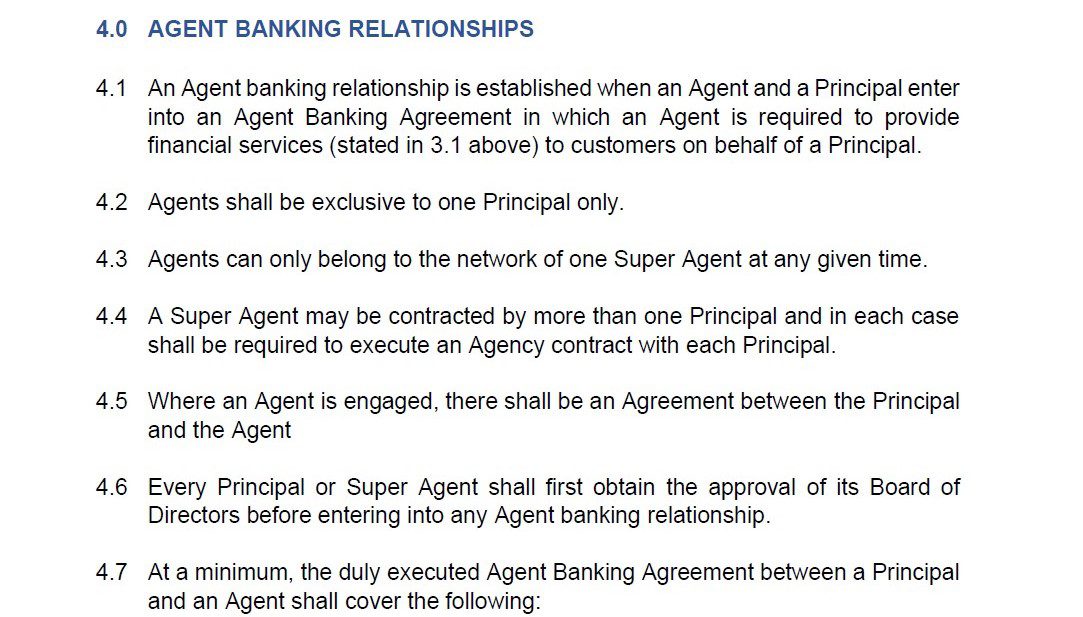

“Agents must maintain exclusivity with one Principal only and can be part of only one Super Agent network at any given time,” the guidelines specify in sections 4.2 and 4.3.

Furthermore, the directive mandates that any Principal or Super Agent must secure approval from their Board of Directors before establishing agent banking partnerships. PoS operators have until April 1, 2026, to comply with this exclusivity requirement, while other provisions, including the revised daily transaction limits, are effective immediately.

This regulatory update coincides with a significant surge in Nigeria’s agent banking sector. Data from the Shared Agent Network Expansion Facility (SANEF) reveals that active PoS terminals have skyrocketed to over 2 million in 2025, a sharp increase from fewer than 350,000 in 2019. This growth underscores the emergence of PoS agents, super agents, and fintech aggregators as one of Africa’s most extensive informal financial networks.

The new framework also introduces safeguards to protect consumers from fraudulent activities and strengthens regulatory supervision over the rapidly growing agent banking landscape.

As part of these measures, the CBN has reaffirmed a daily transaction ceiling of ₦1.2 million for PoS and agent banking operators. Additionally, customers face a daily withdrawal limit of ₦100,000 and a weekly cap of ₦500,000, as outlined in the 2024 regulatory document.

Further Reading: Understanding the ₦1.2 million daily PoS transaction limit and its impact on Nigerian banking.

Enhanced Penalties for PoS Agents and Financial Institutions

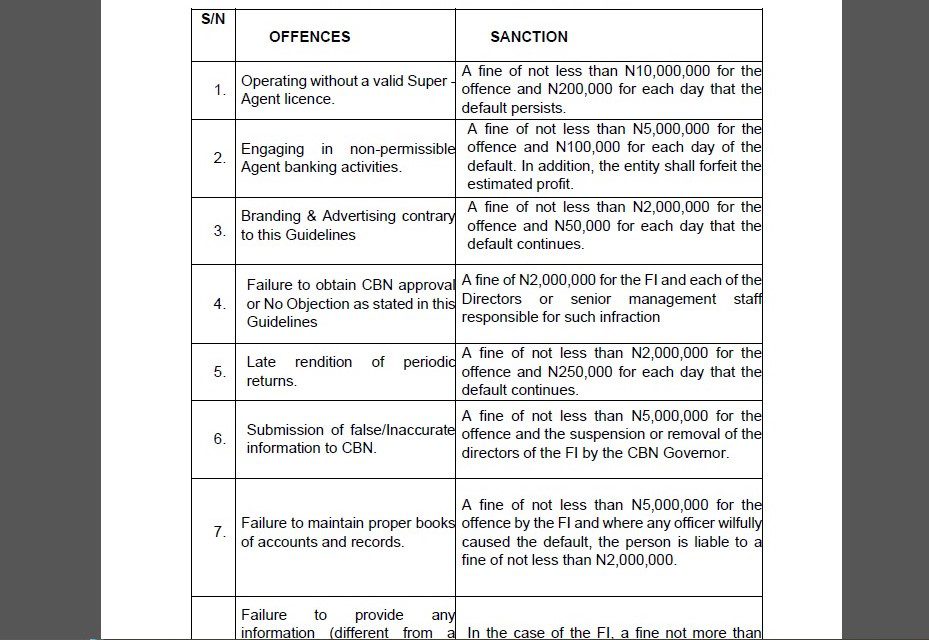

Beyond the exclusivity mandate, the CBN has introduced stringent penalties targeting the agent banking sector. The guidelines impose a minimum fine of ₦20 million on PoS operators who alter their ownership structure without prior regulatory consent.

Violators face a base penalty of ₦20 million, with an additional ₦500,000 daily fine accruing for ongoing non-compliance. The document details various infractions and their corresponding sanctions applicable to both financial institutions and agents.

Key penalties include:

- Operating without a valid Super Agent license attracts a fine of at least ₦10 million plus ₦200,000 daily for continued breaches.

- Engaging in unauthorized agent banking activities results in fines starting at ₦5 million, daily penalties of ₦100,000, and possible forfeiture of illicit gains.

- Non-compliant branding or advertising practices incur fines of no less than ₦2 million, with an additional ₦50,000 daily charge for ongoing violations.

- Failure to obtain CBN approval or a No Objection Letter when required results in a ₦2 million fine for the institution and the same amount for each responsible director or senior official.

- Inadequate maintenance of accounting records leads to a minimum ₦5 million fine for the institution, with an additional ₦2 million penalty for willful violations by responsible officers.

- Changing business names, corporate branding, or logos without CBN authorization incurs a fine of at least ₦5 million, mandatory reversion to approved branding, and ₦100,000 daily fines for continued non-compliance.

- Principals or Super Agents failing to implement control mechanisms such as geo-locking of agent banking devices face a minimum ₦5 million fine plus ₦300,000 daily penalties until compliance is achieved.

The CBN also requires financial institutions to cooperate fully with law enforcement agencies during investigations of fraud or related offenses. If an agent is implicated, the principal institution must suspend the agent immediately and blacklist them upon conviction.

These reinforced regulations are designed to foster a more secure and well-regulated agent banking environment, curbing unethical conduct and minimizing opportunities for fraudulent schemes.

Leave a Reply