FRC Urges Integrity-Driven Reforms to Fortify Nigeria’s Financial System and Boost Trust

…raises alarms over ethical challenges in AI-powered financial reporting

The Financial Reporting Council (FRC) of Nigeria has underscored the critical necessity for reforms grounded in integrity throughout the financial sector to enhance public confidence, ensure market resilience, and foster national progress.

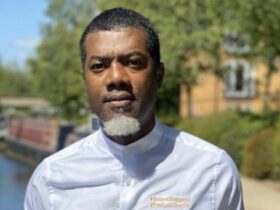

Addressing the 55th Annual Accountants’ Conference hosted by the Institute of Chartered Accountants of Nigeria (ICAN), Rabiu Olowo, the FRC’s executive secretary and chief executive officer, represented by Titus Osawe, coordinating director of Corporate Governance and Inspections & Monitoring, emphasized that ethical leadership is fundamental to accountability and economic advancement.

He defined ethical leadership as the unwavering practice of honesty, openness, responsibility, and moral bravery in decision-making processes, highlighting that it transcends mere regulatory compliance to embody doing what is right even in the absence of oversight.

Olowo cautioned that lapses in ethical judgment have repercussions that ripple beyond individuals, impacting organizations and entire economies. He referenced both international and local financial scandals rooted in poor governance and unethical conduct.

“At its essence, ethical leadership involves consistently upholding integrity, transparency, accountability, and moral courage in every decision. It surpasses compliance; it is about acting rightly even when unobserved,” he stated.

“Within the accounting profession, ethical leadership is not just preferred but essential. Accountants serve as guardians of truth in financial disclosures, custodians of public trust, and defenders of corporate responsibility. The decisions made in boardrooms, audit committees, government ministries, and firms shape investor trust, influence policy, direct capital movement, and ultimately determine the credibility of our financial markets.”

Reiterating the FRC’s role, Olowo explained that the Council actively fosters ethical behavior by establishing standards, registering and supervising professionals, investigating breaches, and enforcing governance frameworks such as the Nigerian Code of Corporate Governance (NCCG) 2018 and the Audit Regulations of 2020.

Related: Investors face N76bn risk as SEC exposes AfriQuantumX Ponzi scheme

He further highlighted the adoption of the International Sustainability Standards Board (ISSB) framework as a pivotal advancement in embedding transparency and accountability within corporate reporting, especially concerning environmental, social, and governance (ESG) disclosures.

Turning to contemporary challenges, the FRC expressed apprehension about the ethical implications posed by artificial intelligence (AI) and digital innovation in accounting and auditing practices.

“Technology and algorithms cannot substitute ethical judgment. As AI and digital tools transform financial reporting, safeguarding the ethical application of data and technology becomes increasingly vital. Professionals must ensure that technological progress does not compromise integrity,” Olowo warned.

He also cautioned against regulatory loopholes, deceptive environmental claims (greenwashing), and the improper use of digital assets, urging accountants to maintain vigilance and uphold ethical principles amid rapidly evolving financial landscapes.

Affirming the Council’s dedication to nurturing an ethical culture, Olowo revealed that the FRC is advancing efforts to integrate ethics more deeply into corporate reporting standards, enhance cooperation with regional and international regulators, and develop new governance codes tailored for the public and nonprofit sectors.

Leave a Reply