Flutterwave UK Posts £2.27 Million Loss in 2024 Despite Impressive Revenue Growth

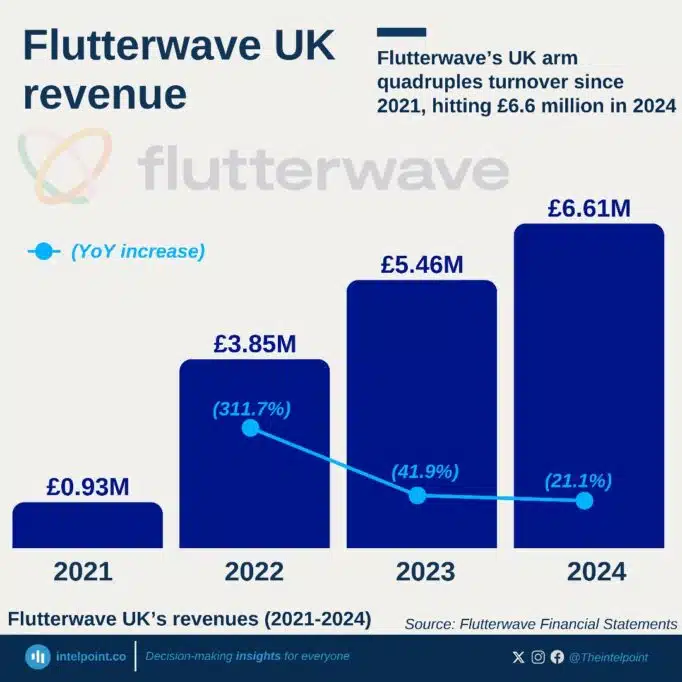

Flutterwave UK has experienced a significant downturn in its financial results for the fiscal year ending December 2024, reporting a net loss of £2.27 million. This marks a steep increase from the £485,000 loss recorded in 2023, despite the company achieving a 21% rise in revenue, reaching £6.6 million.

The firm’s operating profit plummeted by almost 89%, falling to £142,299 from £1.25 million the previous year. A key contributor to this decline was a surge in administrative costs, which escalated from £4.2 million in 2023 to £6.4 million in 2024. This increase is likely linked to higher staffing expenses, as the workforce expanded from 22 to 31 employees during the year.

Additionally, Flutterwave UK reported a £2.6 million loss related to the sale of an investment asset, though the company has not revealed specifics about the transaction. This exceptional charge played a major role in widening the overall losses for the year.

The company’s cash holdings sharply decreased from nearly £15 million in 2023 to just £743,000 in 2024. This dramatic drop may reflect increased operational expenditures, the impact of ongoing losses, or broader difficulties in cash flow management within the UK division.

Other significant changes were observed in the company’s financial position. Amounts receivable by Flutterwave UK plunged from over £4.5 million to a mere £10,000, indicating possible shifts in client payment behaviors or adjustments in accounting practices.

While short-term debts have lessened, they remain considerable at over £12 million. Furthermore, retained earnings swung from a positive £1 million to a negative £1.25 million, underscoring the financial strain.

In 2023, Flutterwave was reported to be in negotiations to acquire Railsr, a UK-based fintech company. However, this acquisition did not materialize. Since then, Flutterwave has continued to broaden its cross-border payment offerings, obtaining licenses in the US, Canada, and multiple African countries to bolster its footprint in key remittance corridors.

“Although Flutterwave UK posted a positive operating profit in 2024, a one-time loss from strategic investment disposals affected the year-end figures but does not reflect the core business’s health. Our group’s half-year 2025 results highlight stronger performance: margins have doubled, enterprise payments increased by 20% year-over-year, and important regulatory approvals have been secured,” the company stated in a release to Techpoint Africa.

Earlier this year, CEO Olugbenga Agboola told Semafor that the company aims to achieve profitability in 2025, while not dismissing the possibility of a future sale.

Leave a Reply