Nigeria @ 65: Manufacturers Uncover Major Obstacles Stalling Industrial Growth

By Yinka Kolawole

As Nigeria commemorates 65 years of independence, its manufacturing industry remains mired in numerous challenges that have hindered its expansion and profitability. Key industry stakeholders highlight issues such as soaring interest rates, rising energy costs, erratic regulatory frameworks, and insufficient infrastructure as major barriers to progress.

Data from the National Bureau of Statistics (NBS) indicates a gradual erosion in the manufacturing sector’s contribution to Nigeria’s Gross Domestic Product (GDP). While the sector accounted for 8.99% of GDP in both 2020 and 2021, this figure slipped to 8.91% in 2022, further declining to 8.64% in 2023, and reaching 8.41% in 2024.

Furthermore, the sector has experienced a negative average annual growth rate of -0.76% between 2019 and 2024, signaling a contraction in real terms over the last five years.

Manufacturers attribute this downturn to a combination of persistent obstacles, including escalating energy expenses, unreliable power supply, heavy dependence on imported raw materials, currency fluctuations, rising borrowing costs, complex taxation systems, logistical inefficiencies, and security challenges.

High inflation has also eroded consumer purchasing power, resulting in weakened demand and mounting inventory surpluses, which underscore a mismatch between production levels and market absorption capacity.

Segun Ajayi-Kadir, Director General of the Manufacturers Association of Nigeria (MAN), told Vanguard that the sector has been severely affected by the Central Bank of Nigeria‘s tight monetary policies, which have pushed borrowing costs to prohibitive levels. “These elevated interest rates place Nigerian manufacturers at a significant disadvantage compared to their international peers,” he noted.

He also emphasized that inconsistent electricity supply, glaring infrastructure deficits, and unpredictable government policies continue to impede efficient production and competitiveness.

Despite these challenges, Ajayi-Kadir expressed optimism that the recent 50 basis points cut in the Monetary Policy Rate (MPR) by the CBN might herald further reductions in lending rates, offering much-needed respite to manufacturers.

“With inflation moderating, exchange rates stabilizing, and investor sentiment improving, now is an opportune moment for the CBN to gradually lower interest rates,” he said. “If manufacturers continue to face borrowing costs exceeding 5%, their ability to compete globally is severely undermined, especially when competitors benefit from substantially cheaper financing.”

Ajayi-Kadir also advocated for the creation of a specialized financing facility that offers loans below the MPR to manufacturers, stressing that such an initiative is vital for catalyzing industrial growth. “The CBN must foster an enabling environment that motivates commercial banks to extend more credit to manufacturers, thereby fueling economic development,” he added.

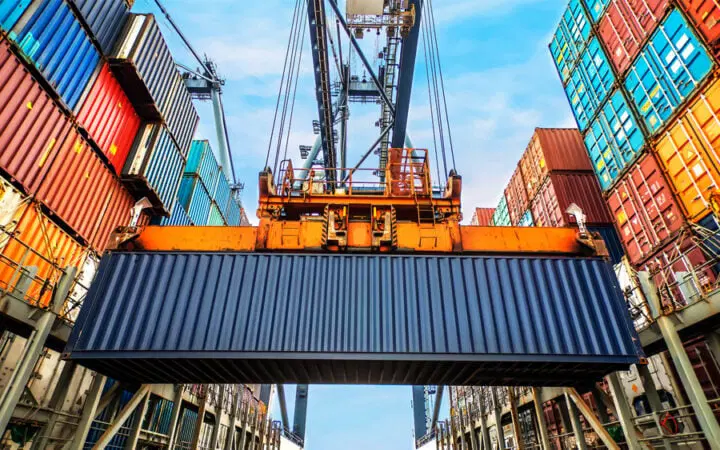

Sunday Okpe, Executive Secretary of MAN’s Apapa Branch, identified customs-related inefficiencies as a significant hurdle. He highlighted that system malfunctions, particularly the failure of the “B’Odogwu” platform to fully replace the Nigeria Integrated Customs Information System (NICIS), have resulted in substantial demurrage charges for manufacturers. Okpe also pointed to unfriendly policies from various government agencies and the burden of multiple taxation as ongoing challenges.

NICIS is a digital solution designed to streamline customs operations, facilitate trade, and manage clearance processes through a unified platform.

Odiri Erewa-Meggison, Chairman of MAN’s Export Group (MANEG), echoed concerns about the dwindling global competitiveness of Nigerian manufacturing exporters. He attributed this decline to high exchange rates, energy costs, multiple levies, port congestion, and infrastructure shortcomings. Erewa-Meggison urged the Federal Government to revisit and reform policies aimed at bolstering manufacturers and enhancing export growth frameworks.

Dr. Muda Yusuf, CEO of the Centre for the Promotion of Private Enterprise (CPPE), highlighted ongoing challenges such as elevated production costs, inefficient logistics, foreign exchange volatility, and competition from cheaper imported products.

Looking forward, Dr. Yusuf proposed several strategic recommendations for government action: lowering energy and logistics costs to improve competitiveness; fast-tracking infrastructure development to unlock value chains in agriculture and industry; expanding affordable credit access for MSMEs and farmers to boost output; promoting local content and import substitution to strengthen domestic resilience; and ensuring policy stability to sustain private sector confidence and attract long-term investments.