Why Savvy Investors Are Looking Beyond Africa’s “Big Four” for New Opportunities

Investment in African startups has traditionally centered on the continent’s four dominant economies: Kenya, Nigeria, Egypt, and South Africa. However, numerous smaller nations, home to some of the fastest-expanding tech ventures, have often been overlooked. At the 10th AfriLabs Annual Gathering, experts discussed how this uneven funding landscape has limited the growth of scalable and sustainable businesses across Africa.

Moderated by Sinazo Sibisi, Chief Investment Officer at Timbuktoo-a UNDP-backed initiative aimed at building a pan-African innovation network-the panel explored strategies to finance innovation on a continental scale. Panelists included Clara Mwangola, Vice President at Kuramo Capital Management; Adebayo Adewolu, CEO of Trium Limited; and Henry Chinedu Obike, Chief Innovation Officer at I&M Bank Rwanda.

Sibisi underscored the critical role of three intertwined factors-speed, scale, and sustainability-in evolving African innovation from isolated successes into globally competitive ecosystems.

“To fast-track the rise of startups that exemplify speed, scale, and sustainability, it became evident that a holistic ecosystem was necessary. This ecosystem would support early-stage research, nurture emerging ventures, and accelerate their growth, ultimately fostering a robust pipeline of high-potential companies ready to showcase Africa’s innovations on the world stage,” Sibisi stated.

Initiated in January 2024 by the United Nations Development Programme (UNDP), Rwanda, and seven other African countries, the Timbuktoo initiative plans to invest $1 billion over the next ten years into 1,000 tech startups across Africa.

As the continent’s largest startup fund to date, Timbuktoo features $350 million in risk-tolerant capital designed to attract an additional $650 million from private investors. The fund operates through regional hubs specializing in sectors such as fintech in Lagos, agritech in Accra, greentech in Nairobi, and health tech in Kigali, working closely with local accelerators and universities.

Edited for clarity and coherence.

Sibisi: Historically, early-stage investments have been heavily concentrated in the big four markets-Kenya, South Africa, Egypt, and Nigeria-and mainly focused on mature sectors like fintech and trade technology.

Why is it essential to broaden investment beyond these established markets and industries? How does the Timbuktoo Accelerator Fund support this expanded vision?

Mwangola: Kuramo is a hybrid private equity fund that invests both directly and through fund managers across sub-Saharan Africa.

Currently managing assets exceeding $500 million, we have backed numerous first-time fund managers, helping to mobilize approximately $3.5 billion in capital into emerging African markets.

Through our affiliate, Moremi Capital, Kuramo oversees the Timbuktoo Accelerator Fund, which aims to deploy catalytic capital across a wider range of geographies and sectors.

Investment has traditionally focused on the big four because these markets are more mature and familiar to investors.

However, as market conditions evolve, expanding our focus is vital. We have diversified from a fintech-centric approach to include critical sectors such as agritech, climate technology, and health tech-industries gaining momentum beyond the big four countries.

This diversification not only mitigates investor risk but also stimulates the development of local ecosystems and businesses in emerging markets.

The Accelerator Fund’s goal is to broaden its reach into new regions and industries, fostering ecosystems that support a diverse array of ventures beyond the conventional fintech narrative.

We believe catalytic capital will be a key driver of meaningful impact across these sectors.

Sibisi: While most venture funds focus on identifying promising entrepreneurs and scaling their businesses, Trium takes a different approach as the fund manager for the Timbuktoo African Gazelles Fund.

How does your model innovate the way innovation is fostered in Africa? Why is it important to move beyond traditional venture capital methods?

Adewolu: Trium functions as a digital venture builder within one of Africa’s largest and most diversified financial services groups.

Initially, we planned to operate like a conventional venture capital firm, but by 2019, we realized that model was insufficient. We adopted the venture builder approach, which was still emerging globally at the time.

We recognized that capital alone does not guarantee success. Effective deployment requires expertise, technology, and a supportive ecosystem that connects the right stakeholders to make ventures viable.

Our aim is to significantly improve success rates-from one in ten startups scaling sustainably to six or seven.

The African Gazelles Fund targets building “gazelles”-companies valued between $100 million and just under $1 billion-rather than chasing unicorns. While unicorns are welcome, our priority is cultivating resilient, mid-sized businesses that can drive Africa’s economic growth.

Large corporations exist but are few; what the continent truly needs are more scalable, mid-tier companies across various sectors and countries.

We identify and develop ventures that address significant market gaps, creating both economic value and social impact while delivering returns to investors.

Sibisi: Henry, access to capital remains a major challenge for many African entrepreneurs.

How can innovative debt instruments help close this gap? Specifically, how does I&M Bank Rwanda collaborate with Timbuktoo as an issuer of innovation bonds to tackle this issue?

Obike: Our bank’s roots trace back to the 1960s when a group of families pooled resources to start a business alongside friends and entrepreneurs. Since then, we have grown into a major corporate entity with subsidiaries in Rwanda, Uganda, Tanzania, Kenya, and Mauritius.

Having personally experienced the challenges of raising capital-starting with angel investors and family seed funding-we understand the need for affordable, lower-risk financing solutions to support SMEs and accelerators.

Many investors view African ventures as high-risk, which drives up borrowing costs. In some countries, loan interest rates can reach 30-35%. Our goal is to design innovative debt products that reduce these costs and mitigate risk.

We are developing long-term debt instruments backed by first-loss guarantees from philanthropic and development finance institutions. This structure lowers risk for larger investors, such as pension funds, encouraging their participation.

Through the Timbuktoo Innovation Bond, we plan to raise capital that provides patient, long-term financing to African accelerators. We anticipate launching this bond early next year, aiming to mobilize local investors and channel funds into ventures requiring sustainable capital.

Recently, I met members of the first Timbuktoo cohort working on health tech innovations in Rwanda. Many had bootstrapped their startups and sought modest funding of around $100,000. With bank interest rates at 17-18%, accessing such capital is nearly impossible.

Our mission is to change this reality by offering debt solutions that enable founders to secure sustainable financing, fostering growth while minimizing risk.

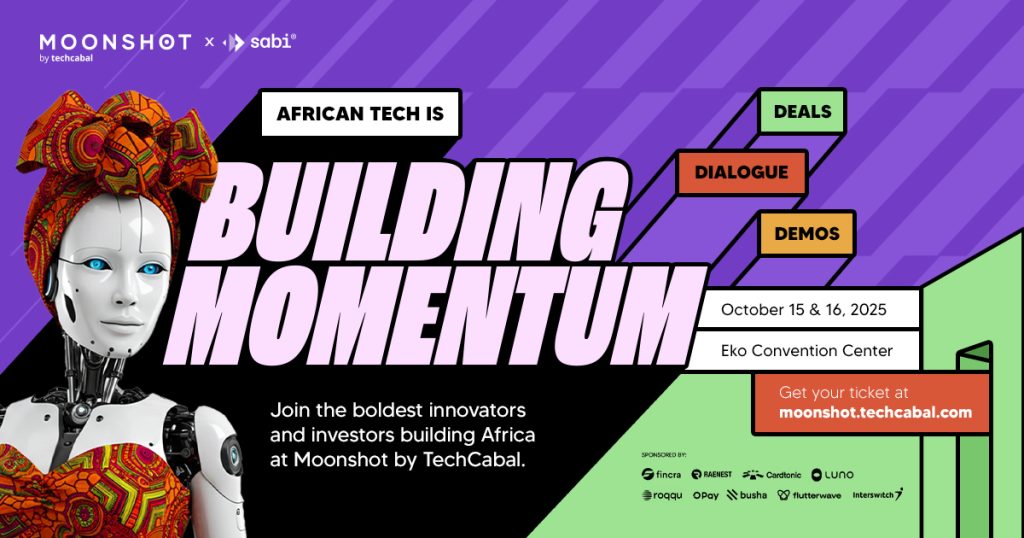

Mark your calendars! Moonshot by TechCabal returns to Lagos on October 15-16. Join Africa’s top founders, creatives, and tech innovators for two days of inspiring keynotes, networking, and visionary ideas. Get your tickets now at moonshot.techcabal.com

Leave a Reply