Paxos Blunders by Minting $300 Trillion in PayPal Stablecoins-Over Twice the World’s GDP!

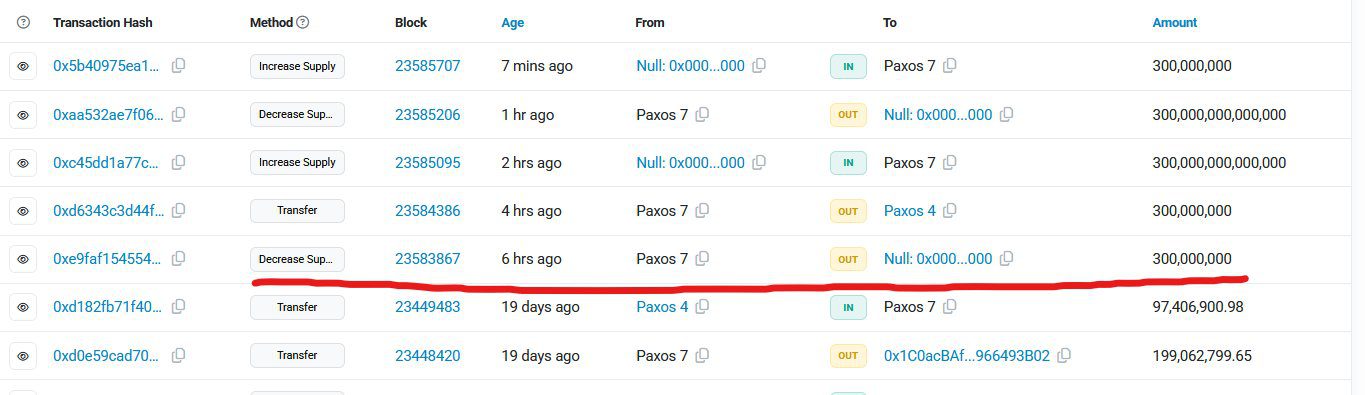

On Wednesday, Paxos, the stablecoin issuer, inadvertently generated an astonishing 300 trillion PYUSD tokens for PayPal on the Ethereum blockchain. This figure is staggering, exceeding twice the size of the global economy’s annual GDP. Paxos attributed the incident to an “internal technical glitch” and confirmed that the excess tokens were promptly destroyed.

Blockchain records reveal that the entire batch of tokens was minted in a single Ethereum transaction before being immediately transferred to a burn address, effectively removing them from circulation. Paxos clarified that this mishap occurred during a routine internal transfer and assured that no customer assets were compromised.

In a statement posted on X, Paxos explained, “At 3:12 PM EST, an internal transfer error caused the accidental minting of surplus PYUSD. We quickly detected the mistake and burnt the excess tokens.”

The company emphasized, “This was purely a technical error within our systems. There was no security breach, and customer funds remain secure. We have resolved the underlying issue.”

The enormity of this error quickly captured widespread attention, becoming one of the most remarkable blockchain mishaps in recent times. Crypto enthusiasts and analysts spotted the anomaly almost immediately, with screenshots of the 300 trillion token figure circulating rapidly across social media. Paxos, which also manages the Pax Dollar (USDP), moved swiftly to clarify that the issue was an “internal ledger malfunction” and was resolved within minutes.

Paxos’ Minting Mishap That Shook the Crypto World Without Breaking It

The sheer scale of the numbers involved made this incident headline-worthy. Since each PYUSD token is pegged to $1, the accidental minting equated to $300 trillion-far surpassing the global economy, which the IMF estimates at around $120 trillion annually.

Within approximately 30 minutes, Paxos had burnt the excess tokens and issued a statement attributing the event to an internal system fault rather than a cyberattack.

Despite the dramatic figures, the market impact was minimal. On-chain data showed PYUSD briefly deviated from its $1 peg by roughly 0.5%, but trading soon stabilized. Decentralized finance platforms like Aave temporarily halted PYUSD transactions as a precaution, illustrating the crypto ecosystem’s rapid response to irregularities.

For PayPal, which introduced PYUSD last year as its premier stablecoin for crypto payments, this incident is an uncomfortable blemish. The company has promoted PYUSD as a fully transparent, regulated stablecoin, backed 1:1 by U.S. dollar reserves and issued by a New York-regulated trust.

While this glitch does not directly undermine the dollar backing, it raises concerns about Paxos’ operational oversight and auditing processes, especially given its role as a trusted issuer.

The Double-Edged Sword of Blockchain Transparency and Human Mistakes

One of the most ironic aspects of this episode is how blockchain’s transparency both revealed the error and confirmed its resolution. Every minting and burning event on Ethereum is publicly visible. Thus, when Paxos minted 300 trillion tokens, the entire community witnessed it, and when those tokens were burnt, that too was visible to all.

This openness acts as both a safeguard and a vulnerability, highlighting the delicate trust balance in modern financial systems. Despite automation and code, human intervention remains a factor-and sometimes, that intervention results in the accidental creation of hundreds of trillions of dollars.

Crypto expert Adam Cochran described the event as “a historic fat-finger error,” noting that token issuers have previously made similar mistakes during internal testing. However, given Paxos’ position as PayPal’s official blockchain partner, the implications are more significant.

Cochran added, “This incident demonstrates that centralized minting control, even within transparent frameworks, is not immune to errors-a point regulators will scrutinize closely.”

Regulatory bodies are already monitoring Paxos. Earlier this year, the U.S. Securities and Exchange Commission challenged the company over its Binance-branded stablecoin, BUSD. Now, with the PayPal collaboration under the spotlight, this mishap intensifies the debate over the true risk profile of regulated stablecoins.

For everyday users, no funds were lost, no wallets compromised, and no market crashes ensued. However, the reputational damage is tangible. Trust, the cornerstone of finance, is far harder to restore than tokens are to burn.

Paxos asserts that it has rectified the root cause and enhanced its safeguards. Yet, as stablecoins become increasingly integral to digital payments and decentralized finance, even minor signs of instability can undermine confidence.

The irony is unmistakable: in striving to streamline money movement through code, Paxos reminded the world that human oversight remains crucial-perhaps now more than ever.

Ultimately, this episode will be remembered as a peculiar chapter in digital finance history-the day $300 trillion was accidentally conjured from thin air, recognized within minutes, and erased just as swiftly.

This is a uniquely crypto story, one unlikely to fade from memory anytime soon.

Leave a Reply