Discover the 20 Game-Changing Fintech Startups Advancing to the MEST Africa Challenge 2025 Semifinals!

MEST Africa has revealed the twenty fintech startups advancing as semi-finalists in the 2025 MEST Africa Challenge (MAC). These innovators will now have the opportunity to present their groundbreaking solutions aimed at tackling financial challenges across the African continent.

In a press release shared on Wednesday and reported by Technext, MEST Africa, in collaboration with Absa, introduced the seventh edition of the competition under the theme “You Build, We Scale.” This initiative encourages fintech entrepreneurs to convert their inventive ideas into tangible impact, spotlighting Africa’s leading ventures in fintech and other critical value chain innovations.

The challenge attracted applications from Absa’s eight strategic markets: Botswana, Ghana, Kenya, Mauritius, Mozambique, Seychelles, Uganda, and Zambia. Absa Group Limited, a prominent pan-African banking institution headquartered in South Africa, operates in ten African countries and was formerly part of Barclays Africa.

Ashwin Ravichandran, Portfolio Advisor at MEST Africa, expressed enthusiasm about the diverse group of twenty founders, each charting a distinct course to revolutionize financial services for Africans. He emphasized that these startups are not only addressing genuine problems but are also laying the groundwork for inclusive economic growth and sustainable development.

“Their innovations blend cutting-edge technology with a deep understanding of community needs, demonstrating that meaningful progress stems from solving authentic challenges locally. We are honored to offer a platform that links them with investors, mentors, and global prospects,” Ravichandran added.

MEST Africa highlighted that the selected startups are tackling some of the continent’s most urgent financial innovation demands. Their solutions cover areas such as advanced payment systems, intelligent credit offerings, cross-border commerce, agri-fintech, and enhancing digital financial literacy.

The semi-finalists were chosen following an initial round where startups submitted online applications accompanied by a concise 3-minute video pitch.

These 20 semi-finalists will present their pitches virtually during the week of October 27, 2025. From this group, only ten will proceed to the final showcase event scheduled for November 26, 2025, in Cape Town, South Africa.

The grand prize winner will be awarded $50,000 in equity funding, gain access to MEST Africa’s extensive network of mentors, partners, and investors, and receive opportunities to pilot their solutions within Absa’s business divisions.

Since its inception in 2008, the Meltwater Entrepreneurial School of Technology (MEST) Africa has empowered over 2,000 entrepreneurs and invested in more than 90 startups. The MEST Africa Challenge remains its flagship pan-African competition designed to discover, nurture, and scale high-potential tech ventures.

Introducing the Semi-Finalists

The twenty semi-finalists represent seven African nations: Kenya (3), Zambia (5), Botswana (1), Ghana (2), Mauritius (1), Mozambique (1), Uganda (6), and Seychelles (1).

Kenya

1. Logistify AI – Employs artificial intelligence to streamline and optimize supply chain and logistics operations.

2. Farmsky Ventures – A digital platform offering crop insurance and last-mile lending solutions, enabling banks and microfinance institutions to efficiently finance farmers and agribusinesses.

3. Investa Farm – An agri-fintech service providing voucher-backed loans for climate-smart agricultural inputs, empowering farmers with accessible financial tools.

Related Read: 20 Nigerian startups chosen for MTN Nigeria Cloud Accelerator Programme 2025.

Zambia

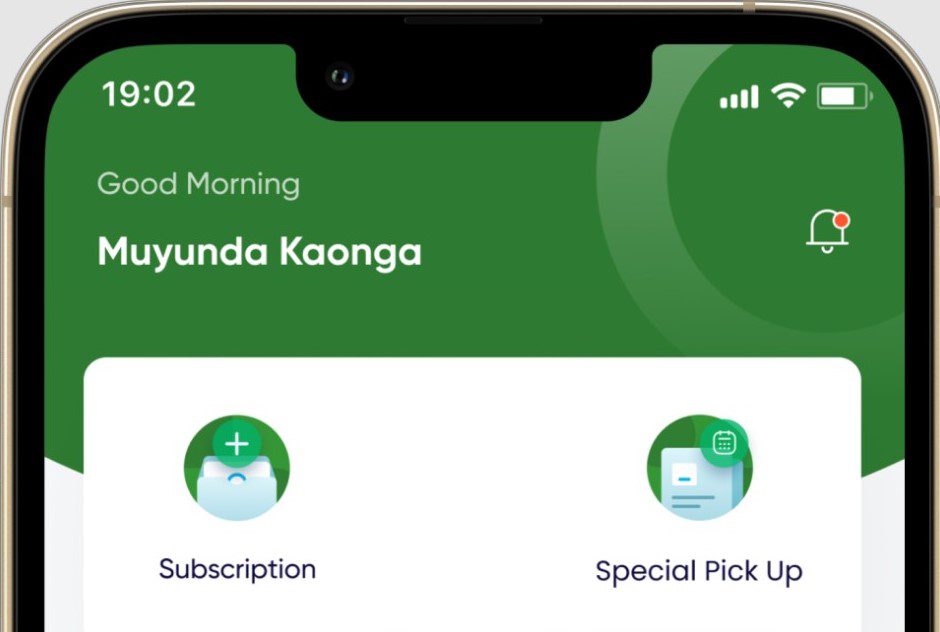

4. Ebusaka Green Technology Limited – A fintech-driven waste-to-value platform that digitizes payment and recycling reward systems, connecting users, waste collectors, and recycling centers through mobile and cloud technology.

5. KreativBox Technology – Provides salary-backed digital loans tailored for civil servants.

6. Mighty Finance Solution Inc – Offers embedded digital lending services to SMEs and women entrepreneurs, simplifying access to credit.

7. Devdraft Ai – Facilitates cross-border payments for freelancers and businesses through stablecoin wallet technology.

8. Homer Price Agency Solutions Limited – Operates a digital banking network with over 550 agents nationwide, deploying agent banking services across Zambia.

Botswana

9. mystock.africa – A retail investment platform granting Africans access to stocks, ETFs, and alternative asset classes.

Ghana

10. Brydge – A supply chain platform that simplifies cross-border trade for African enterprises, focusing on B2B payments and intra-African commerce.

11. Kutana Technologies Limited – Specializes in enabling cross-border B2B trade financing for African SMEs.

Mauritius

12. Black Swan – Utilizes AI and alternative data sources to develop credit scoring models for Africa’s unbanked populations.

Mozambique

13. Simulador Bancário – A digital tool designed to simplify financial planning and loan simulation processes.

Uganda

14. Paytota – A unified payment gateway addressing the fragmented digital payments landscape across Africa.

15. Xzerra – Implements biometric payment technology enabling cashless, fingerprint-based transactions in educational institutions.

16. Kanzu Finance Limited – Provides digital banking solutions tailored for Savings and Credit Cooperative Organizations, Village Savings and Loan Associations, and microfinance institutions.

17. Axiom Zorn – A data-driven innovation company facilitating access to finance and markets for smallholder farmers.

18. Credify Africa, Inc – Simplifies cross-border trade by offering customized financing, payment, and logistics solutions to reduce risks and improve import efficiency.

19. eMaisha Pay – A digital payment platform targeting agro-traders and small enterprises to promote financial inclusion.

Seychelles

20. Fusepay – A licensed Payment Service Provider developing a digital financial ecosystem for emerging frontier markets.

Further Reading: Discover the tech leaders appointed by NITDA to spearhead Nigeria’s digital innovation strategy over the next two years.

Overview of the MEST Africa Challenge 2025 Semi-Finals and Finals

- The top 20 startups will compete in a virtual semi-final pitching round.

- A judging panel will select the leading 10 fintech startups.

- The finalists will then present at the grand finale and Demo Day held in Cape Town, South Africa.

- One overall winner will be crowned.

During the final event, participants will pitch live before a distinguished audience of investors, corporate leaders, and ecosystem stakeholders. The champion will receive $50,000 in equity funding, gain entry into the exclusive MEST Africa Portfolio, have the chance to pilot commercial solutions with Absa’s business units, and unlock additional partner rewards.

Leave a Reply