Afreximbank Aims High: Plans to Grow Balance Sheet to $250 Billion Over the Next Decade

Cairo, Egypt || The African Export-Import Bank, widely known as Afreximbank, has unveiled an ambitious plan to elevate its total assets to an extraordinary $250 billion within the next ten years.

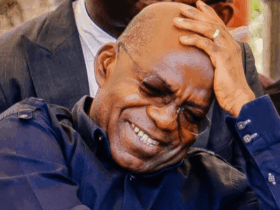

During his inaugural speech in Cairo, Afreximbank’s newly instated president, George Elombi, expressed unwavering optimism about Africa’s capacity to achieve this transformative milestone.

Elombi revealed that conversations with influential leaders, including Egypt’s President Abdel Fattah El-Sisi, have inspired even loftier ambitions, with a potential target of $350 billion in assets. He clarified that this goal transcends mere numbers, representing a strategic commitment to amplify Afreximbank’s role in driving Africa’s economic transformation.

Highlighting the critical need for a robust financial foundation, Elombi stressed the importance of a well-capitalized institution capable of mobilizing the investments necessary to revolutionize Africa’s trade and industrial sectors. Addressing concerns from critics wary of the bank’s involvement in export processing zones, he argued, “Focusing solely on raw commodity exports misses the broader vision. Genuine progress depends on value addition and industrial processing. Africa requires a powerful financial engine to drive this evolution, and we have built such an institution, which we are committed to strengthening.”

Elombi outlined a comprehensive strategy for the coming five to ten years, prioritizing value addition and the local beneficiation of key minerals. “We will no longer finance the export of unprocessed raw materials,” he declared. “This means ending shipments of raw bauxite from Nigeria or unrefined manganese from Cameroon and South Africa. Our focus is on developing domestic processing industries.” He emphasized that refining minerals within Africa will create jobs, boost foreign exchange earnings, and stimulate infrastructure development. “We intend to launch an extensive minerals development initiative that supports the entire value chain-from extraction to refining and manufacturing finished goods,” he added, pledging partnerships with the African Finance Corporation and the Trade and Development Bank in Nairobi to bring this vision to life.

Another pillar of Elombi’s agenda is to boost intra-African trade and promote regional integration. “Our efforts in value addition will only bear fruit if African products can access wider markets,” Elombi explained. He committed to working closely with the African Continental Free Trade Area (AfCFTA) Secretariat to dismantle trade barriers and facilitate the free movement of goods, services, capital, and people across the continent. Addressing African governments, he urged, “Do not fear your own citizens. Too often, Africans are more cautious of each other than outsiders. Open your borders; your people will be your greatest allies.”

Elombi’s third focus area is the development of essential infrastructure to support vibrant trade ecosystems. “Trade cannot thrive without the right infrastructure,” he asserted, emphasizing the need for investments in transport corridors, ports, pipelines, energy grids, and logistics centers. He announced plans to create an integrated, shared infrastructure network that leverages cross-border assets to reduce costs and enhance connectivity. Furthermore, he underscored the vital role of digital innovation, stating, “Africa must harness technology to avoid falling behind.” He pledged investments in digital infrastructure, e-commerce platforms, payment systems, artificial intelligence, and machine learning. He also hinted at exploring the launch of a Pan-African digital currency and stressed the importance of mobilizing African capital globally to fuel development.

Emphasizing the importance of tapping into African wealth worldwide, Elombi highlighted the need to engage the diaspora, sovereign wealth funds, and private African enterprises. “This mission goes beyond finance; it’s about ownership and rewriting Africa’s story of advancement. It’s time for Africa’s wealth, wherever it is held, to be directed toward our shared future,” he affirmed.

Reflecting on Afreximbank’s journey, Elombi noted the institution’s impressive growth since its founding 32 years ago. “In the last decade alone, our total assets and guarantees have increased more than eightfold, reaching $43.5 billion,” he reported. Revenues have multiplied seven times to $3.2 billion, with net income climbing to $1 billion by the end of 2024-a 700% increase over ten years. Capital reserves expanded from $1 billion in 2015 to $7.5 billion in 2024, while callable capital rose from $450 million to $4.5 billion. He also mentioned the creation of subsidiaries such as the Fund for Export Development in Africa, based in Rwanda, which are becoming significant revenue contributors. Addressing skeptics, he defended these initiatives as vital for building the capital base necessary for larger-scale projects.

Elombi reaffirmed his commitment to safeguarding and advancing these accomplishments. “Our fundamental mission is to transform Africa’s trade landscape,” he concluded. “The continent remains overly dependent on commodity exports, and this must change. We need to emphasize local processing and manufacturing. Without production, intra-African trade cannot prosper, and trade itself is a means-not the ultimate goal-of development.”

Leave a Reply