Discover the Top 5 Platforms to Buy and Sell Nigerian Shares – Easy Steps to Get Started!

Traditional savings methods like rotational savings groups (Ajo) or leaving money idle in bank accounts with minimal returns are becoming outdated. Today, trading Nigerian stocks has emerged as a practical investment avenue, especially for the younger generation.

Thanks to technological advancements, there are now endless legitimate ways to earn income remotely. Online investment platforms enable you to put your money into various financial assets such as stocks, mutual funds, bonds, ETFs, real estate, and fixed deposits, allowing your capital to grow over time.

This article highlights five popular platforms for trading Nigerian shares and offers a detailed walkthrough on how to buy and sell stocks using these services.

Based on extensive research, these platforms are widely favored by Nigerian investors.

1. Bamboo

Established: 2019

Founders: Richmond Bassey and Yanmo Omorogbe

Bamboo is a prominent investment app that empowers Nigerians to trade both local and U.S. stocks. Through Bamboo, users can buy, hold, or sell thousands of shares listed on the Nigerian Stock Exchange (NGX) as well as major U.S. exchanges like NASDAQ and NYSE.

The platform provides real-time market data and timely news updates to keep investors informed.

With over half a million users, Bamboo is regulated by both the Nigerian Securities and Exchange Commission and the U.S. SEC, ensuring a secure trading environment.

To begin investing in Nigerian stocks on Bamboo, the minimum amount required is ₦5,000. While fractional shares are not available for Nigerian equities, you can purchase at least one full share priced at or above this amount.

Getting started on Bamboo:

- Download the Bamboo app from Google Play or the App Store and register by completing the KYC process using your Bank Verification Number (BVN) or National Identity Number (NIN).

- Fund your Bamboo wallet through various payment options. The platform accepts local currency cards and handles currency conversion automatically.

How to purchase Nigerian shares on Bamboo:

- On the app’s main screen, tap “Invest” and select “NG Stocks” from the top menu.

- Use the search bar to find the stock you want to buy.

- Tap the stock from the results to view details, then hit the “Buy” button.

- Enter the number of shares you wish to acquire (note: fractional shares are not supported for Nigerian stocks).

- Review your order summary and tap “Place order” to complete the purchase.

To sell Nigerian shares on Bamboo:

Navigate to “NG Stocks” on the homepage, select the stock you want to sell under “My Stocks,” then tap “Sell.” Enter the quantity to sell, review the details, and submit your order. Proceeds from the sale will be credited to your Bamboo wallet within one business day, after which you can withdraw or reinvest.

2. Trove Finance

Founded: 2018

Founders: Oluwatomi Solanke, Desayo Ajisegiri, Austin Akagu, and Opeyemi Olanipekun

Trove Finance is a versatile fintech platform offering access to over 10,000 stocks, ETFs, bonds, and cryptocurrencies from Nigeria and international markets including the US, Europe, and China.

Investors can start with as little as $10 or ₦1,000, making it accessible for beginners and seasoned traders alike.

Trove boasts a user base exceeding 400,000 investors and has facilitated trades worth over $150 million.

To begin trading on Trove: You’ll need your BVN and a valid ID such as a driver’s license, international passport, national ID card, or voter’s card to complete registration.

Steps to buy Nigerian shares on Trove:

- Download and open the Trove app.

- Create an account.

- Switch your portfolio view to “Nigerian Portfolio.”

- Go to the “Explore” tab and select “Nigerian Stocks.”

- Search for the stock you want to purchase.

To sell Nigerian shares on Trove:

- Open your portfolio in the Trove app.

- Select the stock you wish to sell.

- Tap “Sell” and choose your preferred sell order type:

- Market Sell: Immediate sale at current market price.

- Limit Sell: Set a target price for the sale.

- Stop-Loss: Automatically sell if the price falls to a specified level to minimize losses.

- Specify the number or percentage of shares to sell.

- Review and confirm your order to execute the sale.

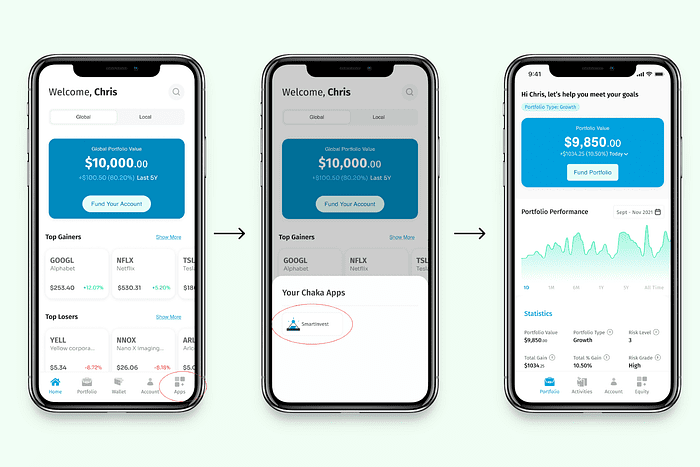

3. Chaka

Founded: 2019

Founder: Tosin Osibodu

Chaka offers Nigerians access to approximately 4,000 stocks from both local and international markets, making it ideal for portfolio diversification. The platform supports both naira and dollar accounts, allowing flexible currency management.

All brokerage services on Chaka are provided through Citi Investment Capital Limited, a licensed Nigerian stockbroking firm regulated by the SEC.

How to start on Chaka: Download the app, register, and provide the required information. Then, fund your Chaka wallet to begin trading.

Steps to buy Nigerian shares on Chaka:

- Tap the search icon on the homepage and enter the stock name or ticker symbol. Alternatively, browse trending stocks on the homepage.

- Input your trade details.

- On the stock’s page, tap “Buy.”

- Specify the number of shares or the estimated cost for market orders (the quantity will adjust accordingly).

- Place your order and await email confirmation. Purchased shares will appear in your portfolio.

To sell Nigerian shares on Chaka:

- Go to your portfolio and select the stock you want to sell.

- Tap the “Sell” button (visible only if you own the stock).

- Enter the number of shares and choose the order type: Market, Limit, or Stop.

- Review and confirm your sale order.

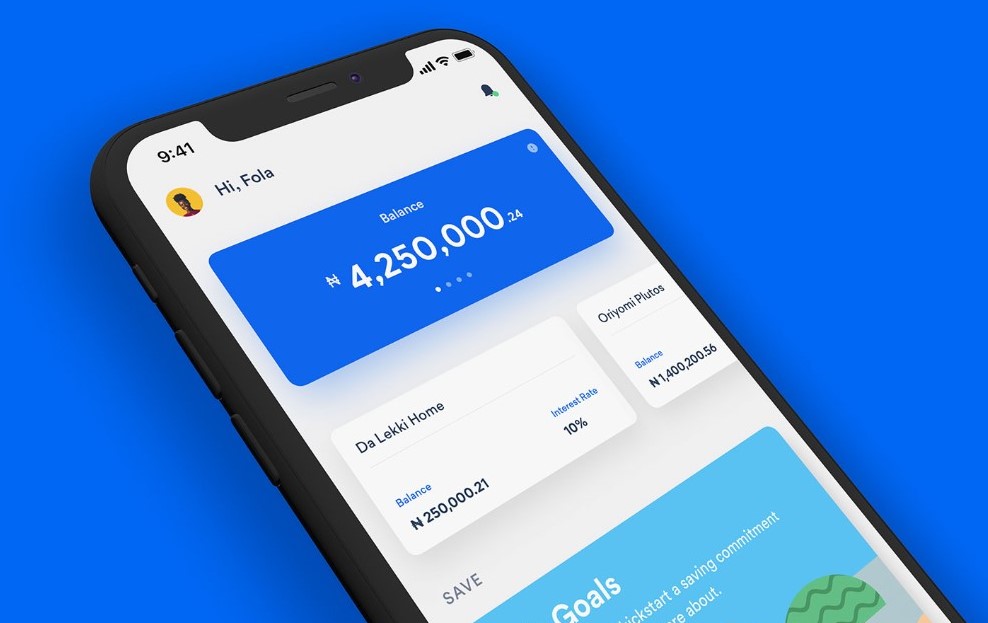

4. Cowrywise

Founded: 2017

Founders: Razaq Ahmed and Edward Popoola

Cowrywise is a Nigerian digital wealth management platform that automates savings and investments. It offers access to a wide range of mutual funds, including options denominated in naira and US dollars.

Users can also trade stocks from over 140 companies listed on the Nigerian Stock Exchange directly within the app.

Cowrywise operates as a licensed fund manager regulated by the Nigerian SEC.

How to buy Nigerian shares on Cowrywise:

- Log into the Cowrywise app and tap the “Invest” tab.

- Select “NG Stocks” on the investment screen.

- Search for the stock you want or browse available Nigerian stocks.

- Tap “Buy” on the chosen stock’s page.

- Enter the number of shares to purchase (minimum ₦5,000).

- Review the order summary including price, fees, and total cost, then tap “Buy Now.”

- Complete payment via bank transfer, linked bank account, or Cowrywise Stash.

To sell Nigerian shares on Cowrywise:

- Go to the “Invest” tab and select “NG Stocks” to view your portfolio.

- Choose the stock you want to sell.

- Tap “Sell” and enter the number of shares to sell.

- If applicable, select the portfolio to sell from.

- Review and confirm your sale order.

5. Afrinvest

Founded: 1995

Founder: Godwin Obaseki

Afrinvest is a well-established Nigerian capital market firm offering services such as investment banking, asset management, and securities trading.

The company provides professionally managed investment products including mutual funds like Afrinvest Dollar Fund and Afrinvest Equity Fund, managed portfolios, and treasury bills tailored for both retail and high-net-worth investors.

Through Afrinvest’s online platform and brokerage services, investors can trade local and international stocks, bonds, and commercial papers.

Afrinvest Securities Limited is licensed by the Nigerian SEC as a broker-dealer and is an authorized dealing member of the Nigerian Exchange Limited (NGX).

How to buy Nigerian shares on Afrinvest:

After downloading the Afrinvest app and registering, submit your documents to have a Central Securities Clearing System (CSCS) account created within 24 to 48 hours. This unique account number is essential for trading on the NGX and will be visible in your profile.

- Log in and fund your wallet via bank transfer or card payment.

- Navigate to the “Invest” tab and select “Nigerian Stocks” to browse available equities.

- Choose the company you want to invest in.

- Review detailed stock information including market data and news.

- Tap “Buy,” enter the number of shares, select the order type, and confirm your purchase.

- Carefully review the order summary before finalizing the transaction by clicking “Buy Now.”

To sell Nigerian shares on Afrinvest:

- Access your portfolio and select the Nigerian stock you wish to sell.

- Tap “Sell,” enter the quantity, and choose your order type (Market or Limit).

- Review the details and confirm the sale.

Important Considerations

- The Nigerian Stock Exchange operates Monday through Friday, excluding public holidays, from 10:00 am to 2:30 pm. Orders placed outside these hours will be processed on the next trading day.

- The NGX follows a T+3 settlement cycle, meaning it takes three business days for proceeds from stock sales to clear and become available for withdrawal.

- All trading activities are fully digital, eliminating the need for physical paperwork.

- Investing in stocks carries inherent risks, and returns are not guaranteed. It is advisable to conduct thorough research and understand the companies before investing.

Leave a Reply