Parthian Partners Raises Urgent Alarm Over CBN’s Drastic 75% CRR Policy Shake-Up

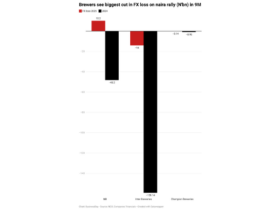

Parthian Partners has expressed serious reservations regarding the Central Bank of Nigeria’s (CBN) recent mandate enforcing a 75 percent Cash Reserve Ratio (CRR) on public sector deposits held outside the Treasury Single Account (TSA). While the directive aims to curb inflation and mop up excess liquidity, the firm cautions that this approach could unintentionally stall Nigeria’s fragile economic recovery.

In their comprehensive report titled “Avoiding a Damaging Cure: Preventing the CBN’s 75 Percent CRR on Non-TSA Public Funds from Hurting the Recovery,” Parthian Partners outlines the potential pitfalls of this stringent liquidity control. The policy, which targets funds from states and parastatals not lodged in the TSA, is viewed as a heavy-handed measure that risks disrupting government cash flows, undermining fiscal governance, and placing additional pressure on the banking industry.

The timing and manner of implementing this policy are critical, the analysts argue. A sudden enforcement could severely limit state governments’ ability to meet payroll obligations, settle contractors, and fund social programs, leading to delays in projects and unpaid salaries. Such outcomes may heighten political tensions by encroaching on states’ fiscal autonomy at a time when cooperative federalism is essential for sustained economic growth. Although expanding TSA usage can improve transparency and accountability, Parthian Partners warns that an abrupt transition without sufficient liquidity buffers could destabilize fiscal management and disrupt vital public services.

Furthermore, the directive is expected to tighten credit conditions as commercial banks will be compelled to hold a larger share of deposits as reserves with the CBN. This contraction in bank liquidity could push borrowing costs higher, discouraging private sector investment and slowing job creation. The firm also highlights the conflicting signals sent by the CBN’s simultaneous reduction of the Monetary Policy Rate and imposition of strict liquidity constraints, which may confuse market actors and undermine the effectiveness of monetary policy.

Parthian Partners underscores that Nigeria’s recent economic gains-marked by growth and easing inflation-are at risk if the CRR policy triggers a liquidity squeeze that curtails public spending and restricts credit availability for businesses. Such a scenario would impede the recovery trajectory and hamper poverty alleviation efforts.

To address these concerns, the firm advocates for a phased implementation of the CRR requirement, allowing states and financial institutions to adjust gradually without triggering a cash crunch. It recommends the creation of temporary liquidity support mechanisms to ensure uninterrupted government operations and suggests exempting capital project accounts during the transition to safeguard ongoing infrastructure development. Additionally, Parthian Partners calls for enhanced coordination and dialogue among the CBN, state treasuries, and finance ministries to balance fiscal discipline with operational feasibility.

In summary, while acknowledging the CBN’s valid objective of maintaining price stability, Parthian Partners stresses that the policy’s rollout must be pragmatic and collaborative. The firm warns that enforcing the 75 percent CRR on non-TSA public funds may offer short-term liquidity relief but risks inflicting long-term economic harm. It urges inclusive stakeholder engagement, a gradual approach, and protective measures to cushion the immediate impact on state finances and credit markets. “Sustaining macroeconomic stability and ensuring efficient public service delivery are intertwined goals,” the firm concludes, “and prioritizing one at the expense of the other will only prolong Nigeria’s economic difficulties and deepen structural weaknesses.”

Leave a Reply