FG mandates TIN for all taxable bank account holders from January 2026

The Federal Government has established a definitive timeline for stricter tax compliance, mandating that banks require a Tax Identification Number (TIN) from all taxable Nigerians maintaining bank accounts beginning January 1, 2026.

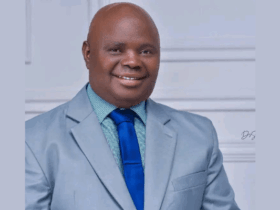

Taiwo Oyedele, Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, disclosed the regulatory overhaul in a recent interview shared on his X account on Thursday. The move is central to the government’s new tax administration framework aimed at expanding the national tax net.

Read also: Zacch Adejeji: Nigeria and France chart a new path for trust in tax reform

Oyedele clarified that the enforcement is backed by Section 4 of the Nigerian Tax Administration Act (NTAA), which is set to take effect on the stipulated date. This provision legally requires a taxable person to register and obtain a TIN.

“A taxable person is anyone who earns income through trade, business, or any economic activity. So banks must request a tax ID from taxable persons,” Oyedele stated.

The Chairman was keen to address public concerns by outlining key exemptions. The mandatory TIN requirement will not apply to non-income earners, such as students and dependents, who will be exempted from needing a TIN to operate bank accounts.

Read also: Here’s why Nigeria’s new tax regime should interest investors, households

He warned that any taxable entity operating without a valid TIN may face restrictions in running their bank accounts in the near future. Mr. Oyedele added that individuals and businesses who have already been issued TINs will not need to re-register for a new one.

The policy, according to the Presidential Committee Chairman, is not entirely new, having been introduced via the 2020 Finance Act. However, the new Nigerian Tax Administration Act provides the formal legal backing necessary for comprehensive enforcement across the banking sector starting in 2026.

Leave a Reply