From Calls to Cash: How a Telecom Giant Transformed into a Banking Powerhouse

Cet article est aussi disponible en français

Originally published on 19 Oct, 2025

How a Telecom Powerhouse Became the Pillar of Kenya‘s Financial System by Chance

Safaricom House”>

Safaricom House”>

Safaricom House. Image: TechCabal

Safaricom, Kenya’s leading telecom operator, never intended to become a financial powerhouse, yet it has emerged as a cornerstone of the country’s monetary landscape. Their 2025 sustainability report highlights a striking fact: Safaricom now supports a vast portion of Kenya’s financial activities.

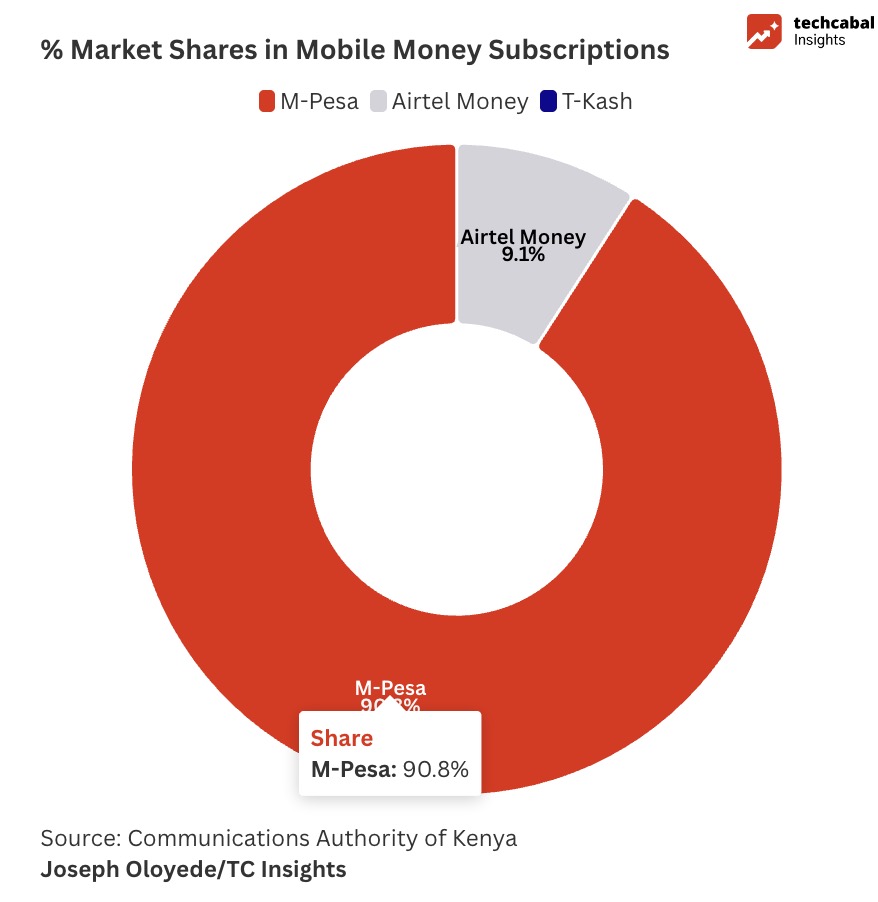

What began in 2007 as a basic mobile money transfer service through SIM toolkit technology has blossomed into the dominant platform for millions of Kenyans to send money, obtain loans, and secure their savings. M-PESA controls over 90% of the mobile money sector, effectively serving as Kenya’s unofficial financial backbone.

This overwhelming market share brings complex challenges. When a private company becomes essential to a nation’s economy, it must shoulder regulatory duties and face increased oversight. Safaricom’s report reveals two key issues: the termination of 113 employees for fraudulent conduct and the implementation of sophisticated AI systems to detect money laundering linked to betting operations.

Kenya’s mobile money market share, Q1 2025

Although the number of fraud incidents may appear concerning, it aligns with expectations for an organization employing over 5,500 people. Financial institutions globally contend with internal fraud, yet few disclose such data publicly. Safaricom’s candidness demonstrates a dedication to transparency and risk management. Importantly, seven cases were reported to law enforcement, a step many firms avoid.

Traditionally, Kenyan banks such as KCB and Equity have managed internal fraud quietly, seldom sharing details openly. Safaricom’s approach is pioneering a culture of openness in a sector that often prioritizes discretion.

The report also uncovers a more nuanced problem: laundering illicit funds through betting accounts. The method is simple yet effective-illegitimate money is deposited into betting wallets, small wagers are placed to mimic activity, and the remaining funds are withdrawn as “winnings,” thereby cleansing the money.

It’s crucial to note that Safaricom does not run these betting platforms but facilitates the payment transactions that support them. This intermediary role compels the company to monitor and trace financial flows between users and licensed operators. In response, Safaricom has strengthened its due diligence for high-volume merchants and uses real-time analytics to identify suspicious patterns. It now verifies betting company ownership and cross-checks transactions against global sanctions lists-practices more typical of international banks than telecom firms. Given M-PESA’s scale, these measures are indispensable.

The fundamental issue is structural: Safaricom’s payment network has expanded so extensively that it operates as a vital national utility. Almost half of Kenya’s GDP passes through its systems annually. This critical role requires Safaricom to function beyond a typical business, ensuring regulatory adherence, operational integrity, and data protection-all while delivering uninterrupted service.

Next Wave continues after this ad.

This dominant position sparks debate. Critics contend that no private company should hold such sway over a country’s financial system. While their concerns are understandable, alternatives remain unclear. Kenya’s traditional banks did not pioneer mobile money at scale, and regulators are still catching up to this new paradigm.

Safaricom is simultaneously a major participant and an informal regulator in a groundbreaking financial experiment unfolding in Africa. It is navigating the complexities of overseeing a financial ecosystem it never intended to create.

The paradox lies in the very qualities that made M-PESA indispensable-its accessibility, speed, and simplicity-also making it vulnerable to misuse. The platform’s openness promotes financial inclusion but also exposes it to exploitation. Safaricom’s ongoing task is to balance these competing priorities without interrupting the smooth flow of transactions relied upon by millions. While fraud can never be fully eliminated, each uncovered case signals a system that is maturing and fortifying itself.

Next Wave continues after this ad.

The report subtly indicates that Safaricom’s entry into financial services was accidental. What started as a telecom’s simple cash transfer tool has, over nearly two decades, evolved into an entity managing anti-fraud and anti-money laundering protocols comparable to a bank. Though unintended, Safaricom now embraces these responsibilities.

Rather than viewing Safaricom as a villain, it should be seen as the custodian of a rapidly expanding infrastructure that outpaced existing regulations. Its current mission is to uphold the system’s reliability and transparency for the millions who depend on it daily.

Kenn Abuya

Senior Reporter

Thank you for reading this edition of Next Wave. I welcome your thoughts and feedback-feel free to email me at kenn[at]bigcabal.com or simply reply to this message.

We’d love to hear from you

Psst! Right here!

Thanks for joining us for today’s Next Wave. Please share this article or subscribe here for free to receive fresh insights on Africa’s digital innovation every Sunday.

As always, I enjoy reading your responses and feedback-don’t hesitate to reach out.

TC Daily newsletter offers a concise summary of essential tech and business news every weekday at 7 AM (WAT).

Follow TechCabal on Twitter, Instagram, Facebook, and LinkedIn to engage with ongoing conversations about technology and innovation across Africa.

Leave a Reply